Adil Najam

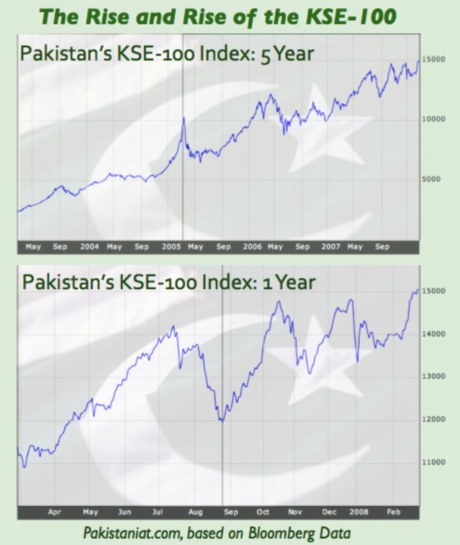

On Tuesday the Karachi Stock Exchange’s (KSE’s) KSE-100 Index – Pakistan’s equivalent to the Dow Jones Index – broke the psychological barrier of 15,000 for the first time. At the time of writing this (on what is Wednesday morning in Pakistan) the Index remains well above that mark.

The rise of the stock market(s) in Pakistan in recent years has been phenomenal. Much of this matches the rise of emerging markets all over the world, but the rise over the last year is particularly phenomenal given just how depressed, depressing, uncertain and unclear the politics of the country has been. My friends who work in the financial sector tell me that money can be made from bad news as much as from good news. I am sure they are right, though I am not sure if I understand all the nuances of how.

But it still intrigues me why and how the market in an economy like Pakistan – where the stock market itself is rather small in terms of size as well as participation – works in relation to what is happening in the society at large. The charts, and news, clearly indicate that the stock exchange in Pakistan has not been oblivious to the political and socio-economic upheavals of the last many months. But the direction seems to have been clearly upwards and it is not clear just how much of those events are reflected in the market.

But it still intrigues me why and how the market in an economy like Pakistan – where the stock market itself is rather small in terms of size as well as participation – works in relation to what is happening in the society at large. The charts, and news, clearly indicate that the stock exchange in Pakistan has not been oblivious to the political and socio-economic upheavals of the last many months. But the direction seems to have been clearly upwards and it is not clear just how much of those events are reflected in the market.

One is used in larger markets (USA, Europe, Japan) to seeing the happenings in society and politics to have deep and immediate impacts on the market fluctuations. Is it the same in Pakistan? Or is it that because so many fewer people are actually invested in stocks that the stock market’s rhythms are less intertwined with local happenings and more with global and international happenings (especially if much of the capital flow is from international investors)? And, if, indeed, the stock market in Pakistan is as much of a barometer and reflection of what is happening in the country, then what is it that the market has been telling us all year, and is telling us now?

I know that many of our readers have far greater expertise in this area. Maybe they can help me and others decipher the meaning of all of this better.

(Graphs from Bloomberg)

The economic results of the decade of 1999-2009 speak much louder than any denials of the reality by the naysayers and Mush bashers, who are highly politicized but mostly clueless about good governance, economy, investing and business.

They are unaware of the best kept secret that Pakistani markets significantly outperformed those in the much hyped BRIC nations by a wide margin.

Pakistan’s key share index KSE-100 was just over 1000 points at the end of 1999, and it closed at over 9727.40 on Dec 31, 2009. Pakistan rupee remained quite stable at 60 rupees to a US dollar until 2008, slipping only recently to about 80 rupees to a dollar. In spite of the currency decline, Pakistan’s KSE-100 stock index surged 55% in 2009 in US dollar terms and 65% in rupee terms, after the IMF bailout that forced the current government to acknowledge the good policies and achievements during Musharaf years.

During the same period of 1999-2009, Mumbai Sensex index moved from just over 5000 points to close at 17,464.81. If you had invested $100 in KSE-100 stocks on Dec. 31, 1999, you’d have over $900 today, while $100 invested in the Mumbai’s Sensex stocks would be worth $274. Investment of $100 in emerging-market stocks in general on Dec. 31, 1999, would get you about $262 today, while $100 invested in the S&P500 would be worth $91.

Pakistan’s KSE-100 stock index surged 55% in 2009 in US dollar terms and 65% in rupee terms, in a year that also saw the South Asian nation wracked by increased violence and its state institutions described by various media talking heads as being on the verge of collapse. Even more surprising is the whopping 825% increase in KSE-100 from 1999 to 2009, which makes it a significantly better performer than the BRIC nations. BRIC darling China has actually underperformed its peers, rising only 150 percent compared with energy-rich Brazil (520 percent) and Russia (326 percent) or well-regulated India (274 percent), which some investors see as a safer and more diverse bet compared with the Chinese equity market, which is dominated by bank stocks. This is the kind of performance that has got the attention of some of the top investors and investment firms around the world.

While such obviously breath-taking results may not mean much to those determined to deny the achievements of a “dictator”, they are not lost on smart investors, like those at Goldman Sachs and Franklin Templeton, both of whom are bullish on Pakistan, in spite of its current difficulties. Musharraf’s legacy will live on with the investors’ faith in Pakistan.

http://www.riazhaq.com/2010/01/karachi-tops-mumbai -in-stock.html

Nilaam, a newly launched auction web site, brings the rich benefits of e-commerce to a growing Pakistani base of Internet users.

“Nilaam will make social commerce a reality in Pakistan,” says Akbar Mithani of Mithani Capital Partners, the U.S. private investment firm that is launching the web site. “We want to expand economic opportunities in Pakistan by fostering an emotionally satisfying experience for Pakistanis to explore, learn, shop, share and talk with each other.”

Nilaam will be launched on April 15, 2008, at http://www.nilaam.pk, with the intention of transforming Pakistani shops and business owners into e-commerce enterprises and entrepreneurs. Nilaam will offer a wide selection of electronics, apparel, automobiles, real estate, gaming, jewelry, music, clothing, and other services.

Nilaam will offer its users many of the features of eBay, such as seller reviews, seller feedback, seller history, buy-now options, and bidding options. The web site will primarily reach out to individuals looking to dispose of goods they no longer want, and as well as small business owners. Shop owners or business owners in Lahore can now sell to buyers not just in close proximity but to anyone even as far away as Karachi or the United Arab Emirates.

“Pakistan has grown from 133,000 Internet users in 2000 to over 18 million today,” says Mithani. “There are no Wal-Marts, No Home-Depots, No Remax’s, No Japanese car dealerships, But now there will be Nilaam, which will bring buying and selling to the consumer’s desktop.”

About Mithani Capital Partners

Mithani Capital Partners is a privately held company specializing in the acquisition and development of innovative education, technology and real estate assets. Mithani Capital Partners develops and implements strategies to harvest ripening opportunities in emerging markets. Having acted as principals in distressed acquisitions, the firm understands the meaning of risk, reward, value enhancement, capital allocation, and profit maximization. Mithani Capital looks for opportunities to create significant consumer value, whether through a New Urbanist influenced development in Pakistan or a new educational avenue in the United States.

By By Shahzada Irfan Ahmed

3/12/2008

LAHORE: At a time when the country is passing through one of the most turbulent times in its history, it is no ordinary development that a Pakistani Internet company has attracted investment from two of the world

Pakistan’s stock exchanges are less susceptible to political instability given that the backbone of the country has always been administrative- the “wretched” bureaucracy which will continue to function as before regardless of who is at the top- military or civilian.

to Ahmad R. Shahid – I under stand from where you are coming and partially what you are saying is probably right but eastern europe was not developed because of massive political reasons which your country does not face on the same scale and besides tell me how many muslims feel it is not “kufr” to invest money in markets as it is so called “haraam” ki kamai ……… and you guys have to be more money savvy and have the feel of the market and live in present world, religion is one part of mans life and he cannot let it rule him for the rest of his life/country or the way he interacts