Adil Najam

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

But it is also my right, and our duty, to point out the silliness – and in this case dangers – of the social messaging contained in some ads.

I have long argued that the emergence of a true and well-managed market for credit is amongst the most important things for Pakistan’s future economic progress, because it will level the economic playing field and enhance both opportunity and choice. Having said that, credit is a tricky commodity and needs to be handled – and marketed – with care.

Even in advanced industrialized economies it can go out of hand — in the US total consumer debt is now nearly US$1 Trillion and can lead to countless wrecked lives.

But, back to Pakistan. The type of aggressive — some will say ruthless — advertising of credit that could lead to immense personal tragedy in the future.

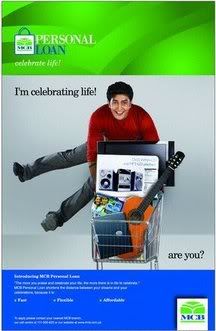

Lets looks at this advert. The young, needlessly exuberant, artificially excited, young man in the ad seems to believe and wants us to believe that the best way to ‘celebrate life’ is to buy a bunch of high-end, imported, luxury item that he can otherwise not afford and probably does not need (a guitar, a top-end cell phone/PDA, an even more top end sound system, and a computer ‘literally’ thrown in). Even if he has to get a loan to do so!

This ad is aimed explicitly at students who are told the loan is ‘Fast, Flexible, Affordable.’ Of course, one does not expect MCB to discuss here what better uses a loan could be put to by a student (tuition and education costs, or an entrepreneurial experiment, for example). But one does expect a reasonable bank to advise young people (as they do in many parts of the world) about thinking carefully about credit.

Loans have to be paid back. Targeting this is an age when young people are just moving from a life where someone else paid their bills to when they have to do so themselves. It can be hard enough keeping on top of current bills and thinking about future loan payments can sound too complicated and too far away, while the excitement of that iPod is immediate gratification and an immediate sense of kool!

Even in countries that can afford otherwise, the habits (and mechanisms) of saving so that when they start their life they have something to start it with. Why are we celebrating so excitedly (see, he is literally jumping with joy!) the prospect of our young leaving college with large and unnecessary debts to MCB?

Get Computer Training Videos of Programming, Graphics, Web Development and Networking. And Learn Computer Education at Your Home.

Thank God the miserable leech like behaviour of most credit card depts within Pakistani banks makes them less popular than they would be otherwise… We would be in real trouble if we were dealing with human beings rather than trolls. The insufferable attitudes, incompetence and chimgadarpana of these credit card phone ninjas creates a natural check on how many people will want to even talk to the bank to get their limits increased.

If you’ve been offered credit cards and have been silly enough to get one, you’ll know what I’m talking about.

The services offered here at online cash advance have helped many individuals to emerge out of sticky financial situations in the shortest ever time possible.