Adil Najam

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

But it is also my right, and our duty, to point out the silliness – and in this case dangers – of the social messaging contained in some ads.

I have long argued that the emergence of a true and well-managed market for credit is amongst the most important things for Pakistan’s future economic progress, because it will level the economic playing field and enhance both opportunity and choice. Having said that, credit is a tricky commodity and needs to be handled – and marketed – with care.

Even in advanced industrialized economies it can go out of hand — in the US total consumer debt is now nearly US$1 Trillion and can lead to countless wrecked lives.

But, back to Pakistan. The type of aggressive — some will say ruthless — advertising of credit that could lead to immense personal tragedy in the future.

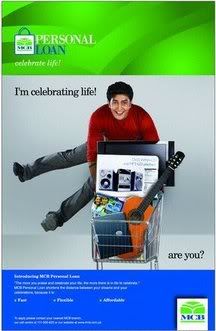

Lets looks at this advert. The young, needlessly exuberant, artificially excited, young man in the ad seems to believe and wants us to believe that the best way to ‘celebrate life’ is to buy a bunch of high-end, imported, luxury item that he can otherwise not afford and probably does not need (a guitar, a top-end cell phone/PDA, an even more top end sound system, and a computer ‘literally’ thrown in). Even if he has to get a loan to do so!

This ad is aimed explicitly at students who are told the loan is ‘Fast, Flexible, Affordable.’ Of course, one does not expect MCB to discuss here what better uses a loan could be put to by a student (tuition and education costs, or an entrepreneurial experiment, for example). But one does expect a reasonable bank to advise young people (as they do in many parts of the world) about thinking carefully about credit.

Loans have to be paid back. Targeting this is an age when young people are just moving from a life where someone else paid their bills to when they have to do so themselves. It can be hard enough keeping on top of current bills and thinking about future loan payments can sound too complicated and too far away, while the excitement of that iPod is immediate gratification and an immediate sense of kool!

Even in countries that can afford otherwise, the habits (and mechanisms) of saving so that when they start their life they have something to start it with. Why are we celebrating so excitedly (see, he is literally jumping with joy!) the prospect of our young leaving college with large and unnecessary debts to MCB?

Franz, sorry for the jargon. But, yes, you got it right. Its essentially teh idea that a lot of my friends – like Ashok Khosla at Development Alternatives India, or Tariq Banuri – have talked about for long. If you want a loan in tens and hundreds of thousands of dollars, you know where to go (traditional banks) and there is a lot of money available…. if you want a loan in tens or hundreds of dollars, you also know where to go (community lending mechanisms) and there is now more money available for this than used to be…. but if you want loans in tens of hundreds of dollars, it turns out to be the most difficult of all to get money…. you are not rich enough for teh banks to consider you credit worthy and you are not poor enough for the development wallahs to be interested in helping you…. but that is often the scale where a lot of enterprise development happens…

A little self-projection, if I might…. Tariq Banuri and I explore some of the bases of these ideas in our book ‘Civic Entrepreneurship’.

Maybe I’m out of the loop… I haven’t come across the term ‘meso-credit’ before…this may be inexcusable since I wrote half my MA thesis on microcredit and banking for the poor. Is that just credit for the void left between the poorest who qualify for microcredit and government & industry that qualifies for foreign direct investment (FDI), World Bank lending or domestic big-bank loans? ….lending “for medium-scale job-creating enterprises and market development”, perhaps (I found that via google in a southern African report from Sussex in the U.K.)

Raza, as I indicated in the post there is a grave danger of the uninitiated jumping into the credit game without realizing its risks. The ease of getting credit in a society not used to it can be a dangerous brew and, like you, it worries me greatly.

On the microfinance side, I fear that even the $20M given in Pakistan as so-called microfinacne is of very poor quality and at least some of it is simple usary imposed through strong arm tactics. Bangladesh, being the leader and lead innovator in the field, is probably the wrong example to compare with. But it is indicative that nowhere has microfinance succeeded simply as a financial instrument. In the absence of an understanding of and a committment to its social dimensions (i.e., credit as a right and social capital as a legitimate collateral) it can lead to significant problems. Having worked in thsi field for long, my fear is that too many microfinance providers in Pakistan have embraced the practice (becasue there was VERY easy donor money for this, without embracing the idea and the key principles behind it). If I am at all correct in this analysis, then one lesson would be that traditional banks are the exact wrong instrument to provide micro-finance (because of questions of scale). However, they may be very well suited as providers of meso-credit … an even less well tapped market and one that is particularly critical to enterpreneurial development.

I don’t think its the customer stupidity or the recklessness of the banks that is to blame here. The simple fact of the matter is the majority craves the materialistic consumerist culture. So if the masses will buy it, the banks will sell – even if they have to hoodwink the gullible.

Pakistan does not have any credit reporting agencies and no standard for credit risk (akin to the US scoring system). I was shocked during a recent trip to Pakistan to see people with credit card limits that are equal to 6-12 months income. I fear there is a huge risk of default that these financial institutions are taking on which could materialize in the event of a any economic slowdown.

On the other hand there is hardly any credit being offerred to the poor which is where access to affordable credit can have a huge positive impact on poverty alleviation and economic growth. Just an indicator Bangladesh has given approximately $800M in microfinance loans while Pakistan has give over $20M.

Banks in Pakistan should use some of their cash to spur this untapped market which has been proven to be successful in many countries for the institutions, the economy, and the poor.