Adil Najam

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

But it is also my right, and our duty, to point out the silliness – and in this case dangers – of the social messaging contained in some ads.

I have long argued that the emergence of a true and well-managed market for credit is amongst the most important things for Pakistan’s future economic progress, because it will level the economic playing field and enhance both opportunity and choice. Having said that, credit is a tricky commodity and needs to be handled – and marketed – with care.

Even in advanced industrialized economies it can go out of hand — in the US total consumer debt is now nearly US$1 Trillion and can lead to countless wrecked lives.

But, back to Pakistan. The type of aggressive — some will say ruthless — advertising of credit that could lead to immense personal tragedy in the future.

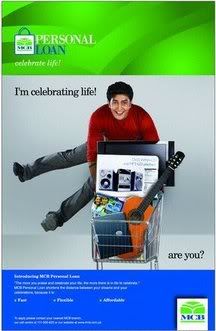

Lets looks at this advert. The young, needlessly exuberant, artificially excited, young man in the ad seems to believe and wants us to believe that the best way to ‘celebrate life’ is to buy a bunch of high-end, imported, luxury item that he can otherwise not afford and probably does not need (a guitar, a top-end cell phone/PDA, an even more top end sound system, and a computer ‘literally’ thrown in). Even if he has to get a loan to do so!

This ad is aimed explicitly at students who are told the loan is ‘Fast, Flexible, Affordable.’ Of course, one does not expect MCB to discuss here what better uses a loan could be put to by a student (tuition and education costs, or an entrepreneurial experiment, for example). But one does expect a reasonable bank to advise young people (as they do in many parts of the world) about thinking carefully about credit.

Loans have to be paid back. Targeting this is an age when young people are just moving from a life where someone else paid their bills to when they have to do so themselves. It can be hard enough keeping on top of current bills and thinking about future loan payments can sound too complicated and too far away, while the excitement of that iPod is immediate gratification and an immediate sense of kool!

Even in countries that can afford otherwise, the habits (and mechanisms) of saving so that when they start their life they have something to start it with. Why are we celebrating so excitedly (see, he is literally jumping with joy!) the prospect of our young leaving college with large and unnecessary debts to MCB?

To Air, or Not To Air (the Ad)…. One way to evaluate at this…. I think one overarching tension here is responsible marketing vs. freedom of commercial expression. Specifically, what is “reasonable” in the context of the type/sophistication of the audience the advertising is targeted towards, and reaching. In the U.S., a “reasonable consumer” standard is generally applied (what’s “reasonable” depends on the audience — elderly, children, etc.). Of course, competing consumer protection and commercial interests play a role as well. Finally, what, if any, safeguards are in place to prevent harm to the consumer are also are a factor.

I don’t know enough about the ad/situation at issue here, but I just wanted to give some food for thought….

i was going to do a post on this on KMB… had the picture taken and all.. then i come upon here :D guess i’ll be cross posting this one as well

This has been a great discussion. you should do more on economic affairs. I have some family members who regularly have to borrown money or cut on other things becasue they are becomming addictsd to teh credit cards. its not crisis yet but could become

Raza, I think you are correct. The challenge is enterprise development. But even more than that it is about ‘livelihoods’ (I realize I am getting ‘academic’ here, but hey that is what I do!). That is a much more useful concept because ‘development’ is a nebulous concept, ‘livelihoods’ is not. Given our population size, and within that the demographics (especially the younger skewed population) the question of employment – and therefore livelihoods – is central. If you look at the economic history of Pakistan, one interesting aspect is that periods of high economic growth have mostly NOT been periods of low unemployment (largely because these periods have usually been buoyed by external forces (especially international assistance, remittances). However, high growth with high unemployment can be a socially volatile mix (and has been for Pakistan)… politically it breeds restlessness and frustration especially amongst the ‘employable unemployed’ (recall Karachi politics in the 1980s as a case study in such frustration)… developmentally, it means that the human resources are not being deployed right. Yesterday they announced the new Gini Coefficient numbers for Pakistan, which suggest a sharp increase in the gap between the top and bottom 20%s in society… this (along with latent inflation) is very disturbing and screams out (again) for concentrating not just on growth but also on issues of employment, of inflation, and of distribution… all of which are critically linked to livelihoods generation.

Adil – great critique on the existing microfinance sector in Pakistan. There are a lot of people doing more harm than good because of the “easy donor money” but there are still a few enterprises that are heading in the right direction. I agree with your point that it is very difficult to get micro finance right. However, I do think that microfinance, if coupled with the social and entrepreneurial ingredients, can be a profitable segment for financial institutions to expand into. There are a few successful examples in India (i think ICICI and a few other banks have micro credit departments). What is critical is that these banks (traditional or new) have to play a much more hands on role with their clients in terms of providing them with sustainable business ideas (beyond just buying an additional goat or cow) as well as ongoing support on how to manage these micro enterprises.