Adil Najam

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

This Muslim Commercial bank (MCB) advertisement prominently covers a quarter of the front page of today’s Dawn newspaper (6 August, 2006). I, of course, have no objections to newspapers selling advertising or to advertisers making whatever ads they want. That is their right.

But it is also my right, and our duty, to point out the silliness – and in this case dangers – of the social messaging contained in some ads.

I have long argued that the emergence of a true and well-managed market for credit is amongst the most important things for Pakistan’s future economic progress, because it will level the economic playing field and enhance both opportunity and choice. Having said that, credit is a tricky commodity and needs to be handled – and marketed – with care.

Even in advanced industrialized economies it can go out of hand — in the US total consumer debt is now nearly US$1 Trillion and can lead to countless wrecked lives.

But, back to Pakistan. The type of aggressive — some will say ruthless — advertising of credit that could lead to immense personal tragedy in the future.

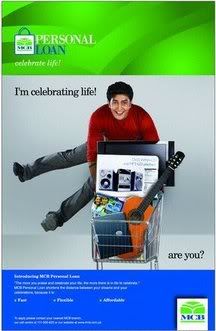

Lets looks at this advert. The young, needlessly exuberant, artificially excited, young man in the ad seems to believe and wants us to believe that the best way to ‘celebrate life’ is to buy a bunch of high-end, imported, luxury item that he can otherwise not afford and probably does not need (a guitar, a top-end cell phone/PDA, an even more top end sound system, and a computer ‘literally’ thrown in). Even if he has to get a loan to do so!

This ad is aimed explicitly at students who are told the loan is ‘Fast, Flexible, Affordable.’ Of course, one does not expect MCB to discuss here what better uses a loan could be put to by a student (tuition and education costs, or an entrepreneurial experiment, for example). But one does expect a reasonable bank to advise young people (as they do in many parts of the world) about thinking carefully about credit.

Loans have to be paid back. Targeting this is an age when young people are just moving from a life where someone else paid their bills to when they have to do so themselves. It can be hard enough keeping on top of current bills and thinking about future loan payments can sound too complicated and too far away, while the excitement of that iPod is immediate gratification and an immediate sense of kool!

Even in countries that can afford otherwise, the habits (and mechanisms) of saving so that when they start their life they have something to start it with. Why are we celebrating so excitedly (see, he is literally jumping with joy!) the prospect of our young leaving college with large and unnecessary debts to MCB?

I know an ex-colleague of mine who actually used CitiBank’s Credit card, exhausted it, then got one from standard chartered, exhausted it, and the best thing is, the credit card people never knew him by face, so he would simply walk up to them in office and say that the person concerned is not in office. To make things worse, he one day told them that their customer has immgirated to Canada…and the credit card people couldnt do nothing. The wosrt part again is, that he always kept people’s money in circulation as debt, like paying my money by getting a load from elsewhere and so on…years after years !

I am very glad you are highlighting this. this is already a problem. A friend of mine first took loans to buy a car he could not affor and is now getting more loans to pay off the loans. He broke down the other day beause he feels trapped in a cycle of debt he can no longer get out of.

this site does have a thing for ads in Pakistan, no? :-)

but this is a really serious issue. credit when used badly can mess people’s life and I think we may be heading that way

Sattar, you are correct. Savings are going down and we are in danger of sliding towards a credit card society. Credit is good but needs safeguard

Very interesting post. A very large number of Pakistanis and I myself routinely criticize what we consider the American society’s attitude towards debt and how banks routinely exploit the lower middle class with credit card offers, 0% APR, etc etc.

It used to be that when a Pakistani started making more money than he was used to getting, he would buy property. Now, that trend seems to be declining as the younger generation has so many outlets to burn money on. I think this can have very dangerous consequences…..OWNERSHIP is extremely important…remember Thomas Jefferson??