Adil Najam

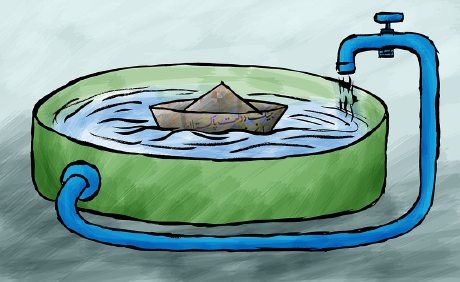

Pakistan needs serious tax reform. That we did not get today.

What it got instead was a collection drive – supposedly to pay for the post-flood rehabilitation, but probably even more because the international community has been pushing us to raise internal revenue collection. That itself is not a bad thing. Indeed, it would be a good thing if the Rs. 65 billion that is estimated to be collected is actually used to reconstruct after the recent floods in Pakistan. Indeed, given the way this taxation is being justified the measure of success of these measures should not be how much money is raised but whether and how much new and additional domestic resources become available for flood rehabilitation.

Given that these and other recent measures are dragging the average Pakistani through serious economic pain, one had hoped that for all this pain one would get the type of structural tax reform that the country needs and deserves: broadening the tax base, tightening tax collection, attacking tax evasion, simplifying tax filing, elimination regressive taxation, and the like. Doing so would not have reduced the public pain, but it would at least have made it worth something if in the run the measures began to put our revenue house in order.

I hold Finance Minister Abdul Hafeez Sheikh in high regard and my sense remains that his own impulse is to move towards more fundamental structural changes that will rationalize the tax system in the long run. Unfortunately, I fear that what he has presented to us now will incite the wrath of the public, ignite the angst of the political parties, but not still deliver the structural taxation reform that is so desperately needed. I hope, therefore, that at the very least, it will actually raise the revenue it is supposed to and – even more so – that this revenue is actually applied to the purpose that it has been raised for (flood reconstruction). If it is not – or if it is perceived to have been squandered or diverted to plugging existing budgetary shortfalls – then we would not only have caused the Pakistani consumers severe economic pain but would also have trampled their trust in taxation as a legitimate state instrument even more than it already is.

For those who may not have been following the announcement from the Federal Cabinet today, here is a goof report of what has been decided, from Dawn:

Facing possibly the toughest moment in the court of people, the PPP-led coalition government approved on Wednesday what is being described here as a ‘mini-budget’ which includes some politically risky taxation measures of over Rs65 billion. These will be taken to parliament for approval by the government in a bid to share the political burden and also backlash. The measures, to be implemented from January next year, were approved by a meeting of the cabinet presided over by Prime Minister Yousuf Raza Gilani.

These include imposition of a 10 per cent flood surcharge on income tax paid by individuals for a period of six months and an increase in the special excise duty on luxury items from one per cent to two per cent. These measures are estimated to yield over Rs40 billion.

The cabinet also approved a draft of the reformed general sales tax (RGST) bill. “Taxpayers over the exemption threshold of Rs300,000 who pay income tax will be subjected to the flood surcharge,” Finance Minister Dr Abdul Hafeez Sheikh said at a press conference also addressed by Information Minister Qamar Zaman Kaira and Interior Minister Rehman Malik. Dr Sheikh, however, did not mention that the flood surcharge would also be imposed on withholding tax paid by various businesses which, economic experts believe, will pass it on to end-consumers.

What the government did not announce is that the RGST bill also proposes withdrawal of tax exemptions on agriculture and textile sectors. The government decided to continue GST exemptions on food items. The rate of GST on sugar will be revised to 15 per cent from the current eight per cent. The tax on telecommunication will come down to 15 per cent from the existing 19.5 per cent.

When asked why had the government failed to impose tax on agricultural income, Dr Sheikh said: “Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. He said the RGST draft had been prepared in consultation with the provinces as under the Constitution collection of tax on services was a provincial jurisdiction and the federal government, if asked by all or any province to collect the tax, would return the entire money so earned to the respective province.

“We are expecting that the current session of parliament will approve the bill before the end of the current year,” the finance minister said, adding that these revenue measures would be finalised after approval by parliament. “Parliament will also give final nod to the RGST bill seeking withdrawal of exemptions and introduction of a singular rate,” he added.

Dr Sheikh said that about Rs10 billion would be generated from an increase in special excise duty on luxury items like cosmetics, cigarettes, soft drinks, etc, Rs27-31 billion from the 10 per cent flood surcharge and Rs25 billion from withdrawal of GST exemptions on goods and services. The proposed bill seeks a reduction in the GST rate to 15 per cent from 17 per cent, doing away with multiple rates, increasing the retailers’ exemption threshold from Rs5 million to Rs7.5 millions and expanding the narrow tax base.

Powerful lobbies which enjoyed exemptions would now have to pay their share of taxes, the finance minister said. Justifying the imposition of taxes, he said the government needed Rs250-275 billion for rehabilitation of over two million flood-affected people — Rs160 billion for cash assistance to the flood-affected families, Rs7 billion for farmers in the form of free seeds and fertilisers and Rs3 billion subsidised credit to the affected people. As per donors’ estimates, Dr Sheikh said, the government also needed $3 billion over a period of three years for rehabilitation of federal and provincial infrastructures affected by the floods.

“Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. Abdul Hafeez Sheikh, Minister of Finance, Revenue, Economic Affairs, Statistics, & Planning and Development, Government of Pakistan

Watan Aziz begs to asks, “How long is long enough?”

“Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. Abdul Hafeez Sheikh, “The Law Abiding” Minister of Finance, Revenue, Economic Affairs, Statistics, & Planning and Development, Government of Pakistan

Vanity Verbosity!

“Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. Abdul Hafeez Sheikh, “The Law Abiding” Minister of Finance, Revenue, Economic Affairs, Statistics, & Planning and Development, Government of Pakistan

Unpretentiously Unlimitedly Undesrvingly Unsettlingly!

“Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. Abdul Hafeez Sheikh, “The Law Abiding” Minister of Finance, Revenue, Economic Affairs, Statistics, & Planning and Development, Government of Pakistan

Taradiddle!

“Personally speaking, I am in favour of taxing the rich, but the Constitution does not allow the federal government to do so because it is a provincial subject”. Abdul Hafeez Sheikh, “The Law Abiding” Minister of Finance, Revenue, Economic Affairs, Statistics, & Planning and Development, Government of Pakistan

Strenuously Straining Sensibility!