Do you remember an old adage:

‘ye cheez to Takkay ki nahiN hai’ (This thing is not worth a Takka).

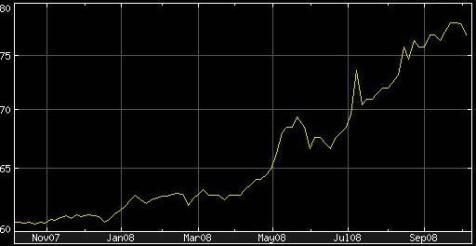

Well, today the tables have turned. What was once true of BD Takka is now true for a Pakistani Rupee. As of today 1 Bangladeshi Takka equals 1.14 Pakistani Rupees . The phenomenal slide of Pakistani Rupee, which started around January 2008 continues unabated. Pakistani rupee is now trading at very close to 80 Rupees to a US dollar. Yahoo Finance was quoting Pakistani rupee at Rs 78.375 to a US dollar on October 6, 2008.

We also had a post on this topic back in May 25, 2008 when Rupee had slid down to Rs 68 for a dollar but this time slide in Rupee’s value seems like the steepest in history of Pakistan. Rupee has lost almost one third of its value in the past 10 months.

The question that everyone is asking is whether current Government is capable of controlling this situation or is it beyond anybody’s control.

Pakistan’s finance Minister (since May 12, 2008) is Mr. Naveed Qamar and atleast I’ve not heard anything from him about what are Government’s plans to bolster Rupee’s value or to stop fast depleting foreign exchange reserves of Pakistan (now down to approx $8.1 bn).

What is happening to a common person among all this turmoil is depicted well in a sher by Anwar Masood.

“jo dil pe guzarti hai raqam karte raheN ge”

kal tum ko bata deN ge raqam kitni bani hai

Reference:

Rs 78 to a dollar for a couple of months should not be worring.

In the last six months the indian rupee has also lost by 7 to 8 rupees.

On your president Zardari- We are happy with his outlook. It

is refresingly different. Why do you put him down as Mr10%.

We want pakistan to prosper and be financially sound. In India

the small scale industry ie investment upto 10crores has given

huge employment oppurtunity.This helps in increasing the manufacturing base. These industries have graduated to medium scale industries in a span of 15 years. large scale

indusries procure components from these small scale industries

and export it to western markets.

@Riaz Haq,

I was amazed at your oversimplified analysis and twisted economic logic on your website. Reading through it seemed more like reading a communist era propaganda about the achievements of the government. Though I should admire that you at least have the honesty to admit mistakes of energy sector. Just this one example is enough to show that how far the government of Shaukat Aziz was from ground realities.

Now to some serious analysis. Stock markets world over are there over secondary trading but the primary purpose is to provide financing for new projects through IPOs, right issues etc. Can you recall a single greenfield project IPO or right issue for financing an expansion in the last 7 years (ignoring the privatization which did nothing but add to government coffers). None.

The talk about all the FDI we received. Did it go for establishing any new plant that increased our export base or manufacturing base. Answer: None. All the FDI went into stock market (secondary and portfolio investment – hope you the difference between primary and secondary market) and real estate taking the prices through the roof and way beyond the reach of a working class salaried person.

The tax to GDP ratio has remained stable during the whole period which means that taxation base has not increased. The only industries that have grown have paid taxes. In our case (and you dont have to take my word for it – read SBP or even your much admired Citibank research reports) the growth has been in services sector mainly banks. So the profitability of the banks has increased manifold which has resulted in higher taxation.

But was the increasing profitability good for economy. When inflation is 13% and banks give depositors a return of 3%, and charge consumer loans of 24%, the only one benefitting in this scheme is the banks. Savings rate has gone down hill. The nation as whole has become hugely indebted by taking on car loans, house loans, credit card loans etc.

I know you will not agree with me. But read the Citibank (which u seem to admire a lot) latest research report of September 08. If you can’t find it, email me, I will email it to you. It clearly mentions that seed for the current crisis were sown in Shortcut Aziz’s regime. Its only now that we are eating the fruit.

Eidee Man,

You say, “Pakistan has one major inlet of foreign exchange: expatriate workers in Gulf countries, and one major outlet: oil!”

I think your statement ignores two other major sources that have significantly declined: Exports and Foreign Investment. Have you thought about why these two declined so dramatically?

You also say, “I think what the government needs to do at this time is to first get the debt situation under control, and then make massive investments in infrastructure, thereby giving employment to millions of people

Comments here have been explaining the reasoning behind the Pakistani economic crisis and indeed are informative.

I would really appreciate if someone can shine the light upon what is the future of Ruppee vs. Dollar ! and our economy.

I’m very surprised none of the commenters mentioned oil. The situation is really not that complex; the value of the rupee is tied in part to our foreign exchange reserves. Pakistan has one major inlet of foreign exchange: expatriate workers in Gulf countries, and one major outlet: oil!

A national budget that spends majority of its foreign exchange reserves on subsidizing oil can simply not sustain the doubling of crude prices, no matter how well planned and strong it is. As much of an adverse impact it will probably have on ordinary people and businesses, the government simply cannot afford to subsidize oil.

Add to that the instability caused by the thawing of an 8-year freeze on the political system, and weekly terrorist attacks, and you may begin to wonder why the economy is holding up as well as it is!

The world is going through a big financial crisis, and certainly Pakistan is going through a bigger one. But this crisis also gives an opportunity to do things right this time. I think what the government needs to do at this time is to first get the debt situation under control, and then make massive investments in infrastructure, thereby giving employment to millions of people…this may not be the best thing for the stock market and other indicators, but in the end it is the best strategy for building a strong foundation for the future.