At the age of 4 me and my elder brother were roughly the same height. Then my brother shot up to almost twice his original height in about a year while my height increased by a mere 30%. In short, I acquired a complex about my height even though I was growing normally. Since my point of reference was Big Brother, I felt shorter after growing 30% than when I was shorter by 23%, simply because Big Brother had grown much taller.

The plight of the Pakistani Rupee in relation to the US Dollar is not much different today.

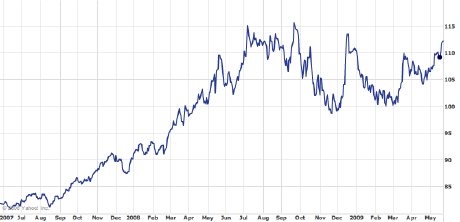

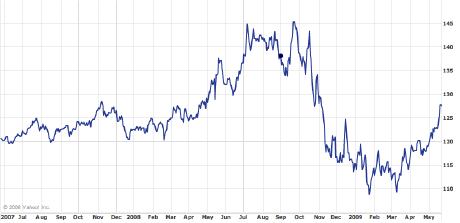

(Above: The rates for the Pakistan Rupee vs. US Dollar, Euro, and British Pound, respectively, since May 2007).

Since July 2008, which is when the USD bottomed, it has zoomed against all major currencies except the yen. Rupee is the same size it was before the USD started zooming. So it looks smaller in relation to the USD. However, when compared to other currencies, the Pakistani Rupee seems almost the same size in relation to many, a little smaller in relation to some and a little bigger in relation to some like the Euro and the British Pound (GBP). However, since the reference point for most Pakistanis is Big Brother, they have a acquired a complex about the size of their currency, which is not supported by reality.

In July 2008, USD was PKR72, EUR was PKR114 and GBP was PKR143.

Today Dollar is PKR81 EUR is PKR110 and GBP is PKR125.

In short, since July, rupee has depreciated against the dollar, but actually appreciated against the euro and GBP. Also the depreciation against the dollar is fully explained by dollar’s apprecaition against other currencies of the world. In short, the Pakistan Rupee has slid, but only against the dollar and not due to a change in Rupee’s fundamentals but due to change in global risk appetite and flight to the dollar as a safe haven.

Compared to the January 2008 figures a not very dissimilar picture emerges.

In Jan 2008 USD was PKR62 EUR was PKR93 and GBP was PKR123.

Again rupee has appreciated slightly against the GBP and depreciated only half as much against the Euro as against the USD.

Then there is the other side of the argument where Brazil and Turkey have stood for a long time. They allowed their currencies to slide for decades to the point of liraization, nevertheless their economies grew robustly over that period. Brazil is the 10th largest economy in the world today at USD1.5 trillion and Turkey the 17th largest at USD730 billion. Today they have stable currencies. However, bulk of their growth occurred during a period of hyperinflation. When they did put the lid on inflation, the cost was a couple of years of steep economic contraction. It is important to note that there is more room to follow inflationary growth policies when the country’s foreign currency debt component is relatively low.

Pakistan needs to grow, without incurring the same level of debt that now has the OECD trapped in a catch 22. To get out of the slump they need to incur more debt. However, their slide was caused by unsustainable levels of debt in the first place. This is a contradiction of the prevailing global monetary system, whereby debt is money. To increase money supply debt has to increase proportionally. It is this system that must evolve to take humanity, not just Pakistan, to the next level.

This is w.r.t your various articles on the depreciating PKR and the Trade deficit problems

Solution to Pakistan Imports/Trade deficit

The burgeoning Pakistani import kills the PKR (due to deficit and FX timing of flows in the spot cash and IBR market) and is a drain of FX earnings

But the solution is simple – just 5 steps .

Step 1 – Ban all luxury imports

Ban all luxury imports,like the destruction of wine and alcohol cedars by Babar,in his conquest of Hindoosthan – as a moral proxy for the jehad in Kashmir,and the character required,to support the Kashmiri freedom struggle against Hindoo oppression.Within that,Liquor,Tobacco,Intoxicants and Cosmetics are easy for a Muslim and would appeal to the common Pakistani (as a sacrifice made by the Rich Pakistanis – in terms of abstinence)

Next are pristine luxuries – watches, cell phones,jewellery,cars and expensive bikes etc – which are really not required at this juncture.,Imports of Liquor etc can be allowed only for Diplomats and Foreign tourists in quotas renewed each year – and imported by CANALISED IMPORTS by Pakistan PSU only.(Embassies,in any case,can import free of restrictions under UN conventions)

Lastly, are autos.There is no need for people for import cars/bikes,if they already have 2 vehicles. So A TBT can be imposed that a certificate is sought on number of vehicles by actual user – at the time of remittance.Some people will use drivers names to import autos – so better to ban them outright.

At a later stage, sole manufacturing and assembly rights can be given to a few licensees to make these items in Pakistan so that the cost of power,labour and some materials are in PKR and the profits are retained for some time,so that some FX is saved,and the rest is postponed.

Most Asian nations are sitting on unused capacities and so low capital goods imports is not an issue,in any case

Step 2 – Restructure Imports paid by Inter bank route

For all imports paid by “inter bank route on CAD or DA” – shift it to LC mode on usance mode (from the Pakistani importer bank).The problem is that some importers may be making small imports and so the cut off limit by value, of imports by amount,can be set.The objective is to roll over the LC payments,as far as possible – so that the date of USD outflow is deferred,for the Pakistan banking system.

If cost of LC usance (on life cycle mode) is high – the importers can use SB LCs to secure the suppliers (who will discount the drafts on Day 1) and the rollover financiers.

As a result,the Pakistani importer will have surplus cash in that period and some importers will divert it – so that cash has to be blocked/liened by the bank on the date of the 1st date of rollover.During the tenor of the LC rollover,the FX position has to be hedged as a mandatory rule and the cash invested in safe T- Bills or Short dated GSecs,to finance the cost of the FX covers.

The importer wil earn a treasury profit,and will have time to fine tune the date of crystallisation of the FX rates on the date of remittances – vs using the IBR TTSR,as of today.In the alternate – Blue chip entities (in terms of ethics) can use the cash surplus of the LC,to discount supplier bills (whose deemed cost of capital is 25-30% per annum) with significant margin improvements for the importer and the suppliers

There is no dearth of banks who will roll over Pakistani LCs of 1st class banks (In Dubai/London/EU/New York. .For Non 1st class banks – some Pakistani Top rated bank or Foreign bank in Pakistan can add confirmation of the LC.LCs can by creative tools be rolled over – forever – till Jesus returns to earth.Some Hedge Funds also might also do it,as it is safe bet with a yield ,way over the USPR.

This will avoid squeeze of USD in the IB markets – data about which is known to bankers,and so is also known to speculators and then the grey market.It affords flexibility in pushing out USD payments at various points of time – and can be restricted at any time by the SBOP.The Uncertainty in the SBOP policy on rollovers will ensure that the market is unaware of the CRYSTALLISED FX Liability on ANY DATE for the banking system (as there will never be a CERTAIN CRYSTALLISED DATE)

So no punter will be able to speculate in the FX market,as the SBOP can change the crystallised liability on any date (unless the SBOP leaks the data) and the date of CRYSTALLISATION CAN BE CHOSEN IN SOME CASES, WHEN THE PKR HAS APPRECIATED

For large importers in Pakistan importing on 90 – 120 days clean credit for many years on a regular basis – factoring and forfaiting limits can be set up in Dubai/London etc., to make the suppliers draw bills of exchange (drafts) for the rollover period of say 180 days or 270 days,which are accepted by the Pakistani importers.The drafts can be factored or forfaited by overseas financiers,with recourse to the importers (at say LIBOR + X points) and with recourse to suppliers (at a lower rate). The Risk is that the Pakistani importer signs the draft and disappears with the money (for the companies with doubtful ethics).In such cases,the importers bank can co-accept the drafts (and block or lien the importer funds)

In the alternate,if the supplier cost of capital is lower, the supplier can “extend longer credit based on SB LC” issued by Pakistani importer (banker) and then “keep rolling it over” – based on “effective rates and arbitrage”

Step 3 – Grey Market Imports

This is the market where “no import duty is paid” and the USD is bought in cash “in advance” in Karachi or HK or Guangzhou. None of the imported items are necessities – denial of which will lead to death of the user.Some portion of the imports are made by baggage imports by air – which is an evil,which can be overlooked.

Speculators take advantage of the squeeze in the interbank and the DEMAND of these grey market imports,to play havoc in the spot market – which hits the headline on the newswire.

The solution is to identify say “500 high value imports by Tariff codes” and BAN Them – and direct only imports vide canalised imports from Pakistan PSUs (called,say SOPSU) with liaison offices in Dubai,HK/Singapore/Guangzhou/Shanghai.The Pakistani importers can identify their supplier and cargo – the chinese supplier will raise the bill on the SOPSU,who will stamp it as accepted – after the Pakistani importer has accepted it – on a back to back basis.The SOPSU will accept it after the Pakistani importer has deposited the PKR in Pakistan,with the SOPSU.

The Chinese importer will take the SOPSU accepted bill to any Chinese bank and get the money. Of course, now the money is “on recprd and liable to Chinese Tax”.However,in Foshan,Chengdu,Dalian,Shanghai,GZOU there are many Chinese financiers,who can discount a draft endorsed by a chinese and PAY IN CASH (with no questions) so long as the drawer has no restriction/objections.

Surely,some Chinese and Pakistanis will start “printing SOPSU acceptances” – SO THE SOLUTION IS TO DIGITISE ALL LIVE ACCEPTANCES and UPLOAD THE SAME,for all discounters to be aware of it (and this is to be printed on the acceptance)

The SOPSU will pay the Chinese banks on deferred payments (after 6/12/18 months) at the pegged rate,on date of acceptance plus interest.

This will take out all the Spot cash USD-PKR demand,in Karachi/HK/Dubai.

Next,it is the Pakistani importers turn to take delivery from the Chinese after receipt from the Chinese banker – and clear it from Pakistani customs

the way he wants (as he is doing today).It is easy to know that the chinese exports recorded from chinese ports do not reach (on paper) the stated ports of import in Africa,West Asia,East Asia and South Asia – so the Pakistani trader can operate the way he wants.

The other way is that the SOPSU can canalise all the logistics in BULK by booking containers with Shipping lines and get much lower freight rates.Some Chinese and other flag carriers with Old Ships and Containers can be used to cut down the freight – where the containers are on the last voyage to the Karachi scrapyard etc. In such cases,the imports will be on record – so the importer will pay only the DEEMED DUTY (bribes) which he is paying currently + freight saved.Since the State has wiped out the hawala and FX punters and launderers, the duty can be lowered to the level of the DEEMED DUTY + freight saved ,as the corruption in Customs is wiped out,FX is controlled and all FX racketeering is wiped out.

Most importantly, since the Pakistani importer has paid the import amount in PKR to the SOPSU on Day 1, the SOPSU will earn interest in PKR,for say 36 months at 20% per annum – which is 30%,and might close out the import financing on a date,wherein the PKR has appreciated (w.r.t the date on Day 1 – as the SOPSU would know the intervention plans of SBOP).For exporter nations,where there is no currency peg w.r.t the USD, the SOPSU will need to hedge the exposures (but the cost will be far below the Treasury gains)

Step 4 – Making Exporters pay for Pakistan Import Duties and FX mismatch (defacto basis)

W.r.t the “indusrial raw materials” legally imported by entities in Pakistan – the imports are “scattered and in small lots” based on “JIT concepts” – and the suppliers are loading “country,price (exchange traded) and credit risk” in the price

These imports should be canalised by a SOPSU whose sovereign status will ensure that there is no country and credit risk in the price.In addition ,since purchases can be be aggregated on a BULK shipment,and ALSO for a LONG TENOR, THE BENEFITS OF STRATEGIC SOURCING WILL ACCRUE. For LME/CBOT/NYMEX/DALIAN/SME products,price formulas and hedges will TAKE OUT THE price risk BUILT INTO THE PRICE – and could reduce the price sharply, in some cases.

If required,the SOPSU can issue a SB LC or a comfort letter,for purchases for 12 months and identify bankers in London,who will provide pre-shipment credit to the exporter of the industrial material (w/o recourse to the SOPSU)

Long term contracts will reduce costs of affreightment.

Then the SOPSU can find bankers to roll over the financing of the purchases,for 12-18 months,with the supplier getting payment on BL SOB.

This will save 15- 25 % in purchase costs and the SOPSU would have deferred the FX outflow with treasury gains,and the BL can be endorsed

to the pakistani user on High seas,or the SOPSU can clear the cargo and sell it to the user

In essence,the cost of the supply chain to Pakistan,is lowered by 20%,and the FX out flow is pushed out by 18 months,and there are treasury gains.The Pakistani user can pay the SOPSU, the way he is paying in the existing mode.

W.r.t the industrial raw materials illegally imported (w/o duty or misdeclaration) by entities in Pakistan – the imports are scattered and in small lots

based on JIT concepts – and the suppliers are loading country and credit risk in the price and THE PAKISTANI IMPORTER IS PAYING ON CASH DOWN MODE (in USD) AS THESE CARGOS ARE MISDECLARED – AND SO,THE CARGO IS INSURED AS X WHEN IT IS Y,AND WITH A VALUE OF A WHEN THE VALUE IS C .

These imports should be canalised by a SOPSU,AS ABOVE, AND THE SAVINGS CAN BE OFFERED TO THE IMPORTER AND HE CAN ASKED TO PAY THE SAME AS IMPORT DUTY.THIS WIPES OUT CUSTOMS CORRUPTION AND ALL HAWALA IN THIS TRADE and ACCRUES REVENUE TO THE STATE. THE IMPORTER WILL PAY THE ENTIRE AMOUNT ON DAY 1 (AS HE IS PAYING TODAY) AND THE SOPSU HAS A ROLL OVER PERIOD OF 18 months,with huge treasury gains and possibility of closing out the trade at an appreciated PKR

Step 5 – Crypto

Pakistani IT experts can tie up with some Chinese engineers to “start a Crypto” for Arabs,Bangladeshis,Lankans and Pakistanis working overseas for their remittances and student fees.This Crypto can be used by DIE HARD PAKISTAN smugglers for payments to suppliers – so that the PKR:USD is not pressured AT ALL FOR GREY MARKET IMPORTS.

The Crypto Algo can be altered,to delete forensic trail,after a certain layer.

>AC Guy

Can you please post the links. I searched the website could not find the articles you are referring to.

Pakistan’s economy is going to send ripples not just throughout Asia, but through the rest of the world. Asia Chronicle (www.asiachroniclenews.com) had a great series of articles on Pakistan not long ago – you guys seem like you’ve been reading them! Good on you!

Rupee’s depreciation has had both advantages and disadvantages.The later being that the country has to pay more in the way of debt payments while the Rupee equivalent of remittances from overseas Pakistanis has gone up many times over.

Someone sending $100 a month to his family in 2007 got them Rs.6,000 while today they get Rs.8,100.The difference has helped the family combat higher utility bills.

Talking about economies of the world,Pakistan is the 26th biggest economy in the world,bigger than many industrialized countries like Norway,Belgium,Sweden,Danmark,New Zealand,Singapore,Poland,Greece and many more who fare way down in the list.

In my decade long career in finance, I have never seen a timeline analysis based on just two years and conclusion derived from a single statistic of exchange rates.

Considering that the world is undergoing a liquidity crunch and credit crisis, which Pakistan is not (nature of crisis in Pakistan is different), Pakistani currency should have been appreciating against GBP and Yen.

Secondly, we need to compare the purchasing power parity of different currencies which author fails to do to reach such a conclusion. Thirdly, author forgets to mention the foreign financial aid we got and the record remittances coming in that keep rupee from depreciating. Fourthly, the rampant inflation in the country which other commentators have pointed out.

Quote

To increase money supply debt has to increase proportionally. It is this system that must evolve to take humanity, not just Pakistan, to the next level.

Quote end

I am speechless.

The whole post was found wanting on so many levels that it reminded me of Akbar Zaidi’s article in newspaper sometime ago where he mentioned that with the plethora of news channels and stock market programs, every business school graduate (he used the term MBA) comes on board talking like an economic expert and throws wild theories around.