At the age of 4 me and my elder brother were roughly the same height. Then my brother shot up to almost twice his original height in about a year while my height increased by a mere 30%. In short, I acquired a complex about my height even though I was growing normally. Since my point of reference was Big Brother, I felt shorter after growing 30% than when I was shorter by 23%, simply because Big Brother had grown much taller.

The plight of the Pakistani Rupee in relation to the US Dollar is not much different today.

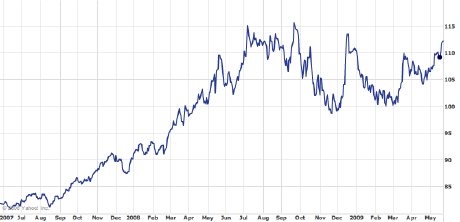

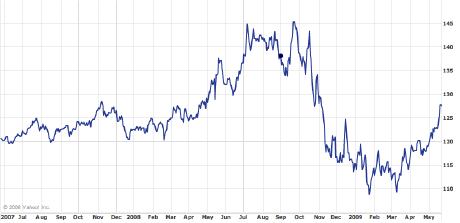

(Above: The rates for the Pakistan Rupee vs. US Dollar, Euro, and British Pound, respectively, since May 2007).

Since July 2008, which is when the USD bottomed, it has zoomed against all major currencies except the yen. Rupee is the same size it was before the USD started zooming. So it looks smaller in relation to the USD. However, when compared to other currencies, the Pakistani Rupee seems almost the same size in relation to many, a little smaller in relation to some and a little bigger in relation to some like the Euro and the British Pound (GBP). However, since the reference point for most Pakistanis is Big Brother, they have a acquired a complex about the size of their currency, which is not supported by reality.

In July 2008, USD was PKR72, EUR was PKR114 and GBP was PKR143.

Today Dollar is PKR81 EUR is PKR110 and GBP is PKR125.

In short, since July, rupee has depreciated against the dollar, but actually appreciated against the euro and GBP. Also the depreciation against the dollar is fully explained by dollar’s apprecaition against other currencies of the world. In short, the Pakistan Rupee has slid, but only against the dollar and not due to a change in Rupee’s fundamentals but due to change in global risk appetite and flight to the dollar as a safe haven.

Compared to the January 2008 figures a not very dissimilar picture emerges.

In Jan 2008 USD was PKR62 EUR was PKR93 and GBP was PKR123.

Again rupee has appreciated slightly against the GBP and depreciated only half as much against the Euro as against the USD.

Then there is the other side of the argument where Brazil and Turkey have stood for a long time. They allowed their currencies to slide for decades to the point of liraization, nevertheless their economies grew robustly over that period. Brazil is the 10th largest economy in the world today at USD1.5 trillion and Turkey the 17th largest at USD730 billion. Today they have stable currencies. However, bulk of their growth occurred during a period of hyperinflation. When they did put the lid on inflation, the cost was a couple of years of steep economic contraction. It is important to note that there is more room to follow inflationary growth policies when the country’s foreign currency debt component is relatively low.

Pakistan needs to grow, without incurring the same level of debt that now has the OECD trapped in a catch 22. To get out of the slump they need to incur more debt. However, their slide was caused by unsustainable levels of debt in the first place. This is a contradiction of the prevailing global monetary system, whereby debt is money. To increase money supply debt has to increase proportionally. It is this system that must evolve to take humanity, not just Pakistan, to the next level.

I am intrigued by the implication that hyperinflationary policies can result in rapid growth. Is that what really happened in Brail and Turkey ?

You ignore the deleterious effects of “hyperinflation” and “inflation” on the poor – most of who are already suffering from massive increases in the price of staple goods.

A recent report by the IRI revealed that the most important national issues for Pakistanis are Inflation (46%), and Unemployment (22%), followed by Terrorism (10%). It is evident that the consolidation of democracy in Pakistan will depend on the democratic regime’s ability to assure sustainable livelihoods and safety nets for the people. The Musharraf regime was able to rally support in 1999 due to Bhutto and Sharif’s disastrous economic policies. I suggest we pay close attention to inflation – unless, of course, we want another military coup.

Like the positive outlook.

But tell this to someone who has to use the rupee to buy daily goods and cannot make ends meet.

I am sorry but I am missing what the big point is. The Ruppee is pegged to the dollar and therefore its value on other currencies move with dollars value. So, why is that surprising?

We had not planned it as such, but we just noticed in the “ATP 1 Year Ago” column that exactly one year ago today we had carried a very related post, titled: “Pakistani Rupee’s Record Slide Versus US Dollar”