Do you remember an old adage:

‘ye cheez to Takkay ki nahiN hai’ (This thing is not worth a Takka).

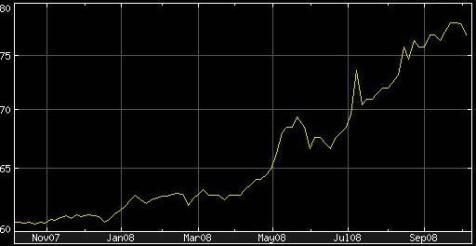

Well, today the tables have turned. What was once true of BD Takka is now true for a Pakistani Rupee. As of today 1 Bangladeshi Takka equals 1.14 Pakistani Rupees . The phenomenal slide of Pakistani Rupee, which started around January 2008 continues unabated. Pakistani rupee is now trading at very close to 80 Rupees to a US dollar. Yahoo Finance was quoting Pakistani rupee at Rs 78.375 to a US dollar on October 6, 2008.

We also had a post on this topic back in May 25, 2008 when Rupee had slid down to Rs 68 for a dollar but this time slide in Rupee’s value seems like the steepest in history of Pakistan. Rupee has lost almost one third of its value in the past 10 months.

The question that everyone is asking is whether current Government is capable of controlling this situation or is it beyond anybody’s control.

Pakistan’s finance Minister (since May 12, 2008) is Mr. Naveed Qamar and atleast I’ve not heard anything from him about what are Government’s plans to bolster Rupee’s value or to stop fast depleting foreign exchange reserves of Pakistan (now down to approx $8.1 bn).

What is happening to a common person among all this turmoil is depicted well in a sher by Anwar Masood.

“jo dil pe guzarti hai raqam karte raheN ge”

kal tum ko bata deN ge raqam kitni bani hai

Reference:

hi paki frnds,

I m an indian or hamari currency value apki currency se kafi zyada strong h,

1US $= 46 INDIAN RUPEES(&still getting stronger) it is because we r one of the strongst economy in asia after china.,

So bhai jaan lage rho…

Allah mafi deve tum logon ko.

Businessmen and everyone else save their income in international banks in different currencies, not in Pakistani rupees – so there is really no way of telling how much money is earning from trade. Businessman however will never save foreign currency in Pakistan ever again.

No one can open a new account in any Pakistani bank is a problem. The State Bank of Pakistan requires ‘Documented Proof of |Income’. A person suddenly inherits a large sum of money, how will he save that money if the private bank will not allow him to have an account prior to that?