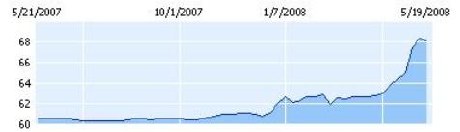

According to money central at msn, Pakistani Rupee was traded at US $68.25 today. Just around January of 2008, Rupee was quite steady at around 61 rupees to a dollar but in the past 4 months, the depreciation has been alomst 10%. That too at a time, when US dollar is also weakening as compared to other major curencies of the world. Following graph shows Rupee’s one year comparison versus the US dollar.

On May 23, 2008, ONE Unit of other currencies was equal to following number of rupees:

1 Australian Dollar = 65.64 Pakistani Rupees

1 Bangladesh Takka = 0.99 Pakistani Rupees

1 Canadian Dollar = 69.09 Pakistani Rupees

1 Chinese Yuan = 9.84 Pakistani Rupees

1 Euro = 107.73 Pakistani Rupees

1 Indian Rupee = 1.6 Pakistani Rupees

1 Iraqi Dinar = 0.06 Pakistani Rupee

1 Kuwaiti Dinar = 257.58 Pakistani Rupees

1 Saudi Rial = 18.23 Pakistani Rupees

1 Thai Baht = 2.12 Pakistani Rupees

1 UAE Dirhan = 18.61 Pakistani Rupees

1 Zimbabwe Dollar = 0.002 Pakistani Rupees

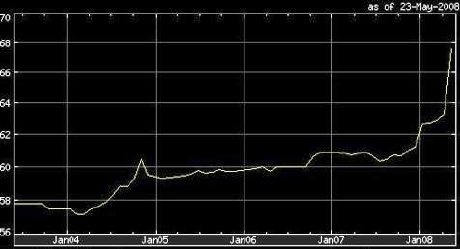

Following graph is the 5-year view of Pakistani rupee versus the US dollar. One can easily note the alarmingly sharp decline in the value of Rupee in the last few months.

Following graph shows Rupee’s sharp decline as of August 7, 2008

References:

1. Money central, msn

2. Yahoo Finance

Eidee Man is right; tax truancy is a huge problem in Pakistan–maybe the biggest one.

Look at the two or three growing powers. They do not have much in common.

One is a Communist country which holds 800 billion rural peasants in bondage only comparatively better to what they suffered when their country was run by warlords. No need to worry about where the money is coming from there–the State owns everything in China.

India is a growing country thanks to its individual multi-billionaires, but there can still be found dead bodies lying on the streets. India’s growth will be in vain until it addresses some of the vast inequities in its population. Not to mention, there are always security problems in a country which really hasn’t outgrown its third world rich-poor divide. India’s big strength right now is its educated, tech-savvy, English speaking lower middle class workforce.

Then you have resurgent Europe, with a heavy dose of capitalism-friendly social justice and high taxes for all, but at least you get something for them ( a decent social net). The real reason Europeans can afford all this–but please don’t tell them–is that they are not militarized; the Americans do the heavy lifting for them in that area.

Looking at all this, it seems that what would most help Pakistan would be to curtail militarism, which is very costly (what do you need all that hardware for, anyway?), and institute sweeping social/educational reform financed by aggressive taxation of the disproportionately wealthy and property owners.

Or, if that seems too extreme and radical (and some people will immediately cry out that is does), you can always wait until people starve and let them do a Nepal on you–if you get that lucky. Surely mob rule led by illiterate guerrilla leaders who call themselves Communists or mullahs or whatever will lead Pakistan in the right direction….after all Somalia is doing so well these days.

Jamshed Nazar…very well written post. I agree with your conclusions. I think at the end, Pakistan needs to define and find a niche, be it low cost manufacturing, IT outsourcing etc. in varius economic sectors. Unfortunately we have not been able to differentiate our sectors with the global competitive forces on a major scale. That at the end always becomes a policy driven issue. Ofcourse consistency in policies, economic/political stability, and basic/technical education is required for strong foreign investments and the economy to fight the competitive pressures.

The key problem with the ruppee is the large trade deficit of 13+ billion dollars. On top of it add the huge current account deficit of 7+ billion dollars and you have a classic “run on currency” crisis.

These holes were plugged in earlier by oversees Pakistanis 6+ billion, 2-3+ billion of american money for “war on terror” (documented and undocumented transfers) and 5+ billion of forein investments in portfolio (financial markets / acquisitions) and direct investments (projects like telecoms).

What has happend in the last six months is that the doubling of oil price has resulted in the government to borrow an extra 5+ billion from the state bank to make these payments and causing a drop of 5 billion in the foreign exchange reserves of the bank for every one to notice. (Forex reserves at SBP peaked at 16.5 billion$ in october and currently are around 11.5 billion).

The second problem is that the Americans are holding payments as a pressure point to push the new colaition to toe the American line for the terror war stuff. I would not call it black mail since it is our fault that we are hooked on to the American Aid.

There are serious long term structural problems in the Pakistani economy as everyone can see. Power, enegery, water, edibles you name it and we have a shortage. The only thing in abundence is population and the goverment is failing to provide basic health care, education, housing, employment and even security to the common man.

The two biggest topics to address in pakistan are the trade policy and the need and role of the armed forces.

we are importing cheap foreign made stuff (chinese and other) stuff ranging from shoes, needles, candles, rickshaws, generators, food items, clothes, cell phones etc. All this stuff improted from somewhere abroad is killing our local manufacturing on one hand and pushing pressure on the ruppee on the other since firen goods need dollars for payment. When the Pakistani goverment signed on free trade agreements, the assumption was that overall we may lose on some sectors but we will gain in other sectors and overall more trade will benefit the economy. However, it is clear from the huge trade deficit that “free trade” is bad for the country. The exports have stagnated while improts are ballooning above 30% a year. Where is the money to pay for all these imports?

the second issue is the cost of 600,000+ paskitan army which needs to be fed, housed and maintained in mint condition at the cost of 4-5+ billion dollar a year. what is it worth for? half of the country’s life, the generals have been invading the country itself. Most of the time, the army strategy is focused on how to sell itself to the americans to do the dirty jobs so that the pakistani army pays its bills and has “things to do”. There is a long list of pakistani army’s adventures from seato / cento to afghan war to the current services along the afghan border.

In any case, the issue is that we cannot sustain these large investments on the army and cuts are required. Case in point – the Pakistanis have bought 10+ billion$ of arms in the last five years. Who is paying the bills??

The current outlook maybe slightly positive for the ruppee since I expect oil to drop below 80$s due to global recession and the goverment to patch up with the americans so that dollars start flowing in again from the pentagon. Global GDRs / selling the national silverware is also expected to generate some cash and the gulf rich economies will invest for the power plant projects in the next couple of years.

probably Zardari and NS contacts should bring in some new cash until the Army decides to jump in again.

However, watch out for bank defaults, non-performing loans, flight of capital, stock market crash and IMF’s rescue packages. I would say there is a 30% chance of an economic meltdown curtesy of our previous trade and financial managers.

For the common man though, life’s going to get tougher still. The gornment is able to service an ever decreasing amount of its population and this trend shows no sign of gonig away.

My dear countrymen, please do not think that things are so simple and that we are free to make our policies independently. Can any of you ever thought why our economy paints a rosy picture under authoritarian rule? and why does it look in shambles under civil rule? Even the rating agencies were feeling good about us just a few month back but all of a sudden they too have downgraded us while the political govt have not even adjusted itself in office!!

As jk has suggested that with decline in the value of Rupee we can benefit with more exports as it becomes cheaper for other countries to buy pakistani products but what you missed here is the impact of this decline on imports … with this sharp decline in the value of Rupee the imports are getting more and more expensive day by day and for producing many of our export goods we import machinery and raw material so the net impact will be negative for Pakistan as export will become expensive due to high cost of production …. this decline in Rupee value has many reasons like high inflation rates …. poor monetary policies …. and the most major one is speculation in money market and State Bank’s complete faliure to control it ….