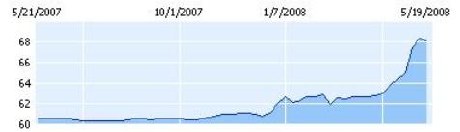

According to money central at msn, Pakistani Rupee was traded at US $68.25 today. Just around January of 2008, Rupee was quite steady at around 61 rupees to a dollar but in the past 4 months, the depreciation has been alomst 10%. That too at a time, when US dollar is also weakening as compared to other major curencies of the world. Following graph shows Rupee’s one year comparison versus the US dollar.

On May 23, 2008, ONE Unit of other currencies was equal to following number of rupees:

1 Australian Dollar = 65.64 Pakistani Rupees

1 Bangladesh Takka = 0.99 Pakistani Rupees

1 Canadian Dollar = 69.09 Pakistani Rupees

1 Chinese Yuan = 9.84 Pakistani Rupees

1 Euro = 107.73 Pakistani Rupees

1 Indian Rupee = 1.6 Pakistani Rupees

1 Iraqi Dinar = 0.06 Pakistani Rupee

1 Kuwaiti Dinar = 257.58 Pakistani Rupees

1 Saudi Rial = 18.23 Pakistani Rupees

1 Thai Baht = 2.12 Pakistani Rupees

1 UAE Dirhan = 18.61 Pakistani Rupees

1 Zimbabwe Dollar = 0.002 Pakistani Rupees

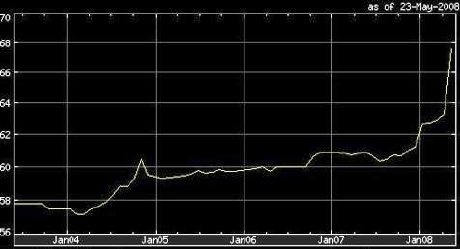

Following graph is the 5-year view of Pakistani rupee versus the US dollar. One can easily note the alarmingly sharp decline in the value of Rupee in the last few months.

Following graph shows Rupee’s sharp decline as of August 7, 2008

References:

1. Money central, msn

2. Yahoo Finance

A pip calculator is an essential tool for every forex trader—beginner or experienced. It simplifies your pip value calculations, helps you manage your risk effectively, and improves your overall trading strategy. Instead of depending on guesswork or doing manual math, you can rely on a pip calculator to give you fast, accurate, and dependable results.

A pip calculator is an essential tool for every forex trader—beginner or experienced. It simplifies your pip value calculations, helps you manage your risk effectively, and improves your overall trading strategy. Instead of depending on guesswork or doing manual math, you can rely on a pip calculator to give you fast, accurate, and dependable results.

Nice blog, are you searching for the forex prop calculator that helps you plan trades with clear lot sizing and controlled risk? Then this platform is for you. A good tool brings instant clarity on pip value, margin use, and position sizing, making trading more structured. With the right numbers in hand, you stay focused, avoid emotional decisions, and build a smoother trading flow. A forex prop calculator also supports consistent planning as you shift between pairs or timeframes. It adds confidence and keeps your strategy aligned with your goals. For more insights, visit us.