Do you remember an old adage:

‘ye cheez to Takkay ki nahiN hai’ (This thing is not worth a Takka).

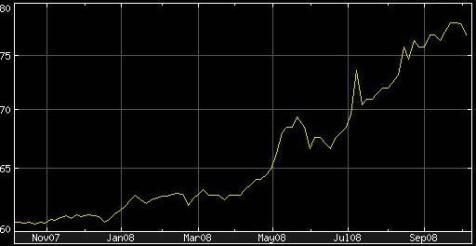

Well, today the tables have turned. What was once true of BD Takka is now true for a Pakistani Rupee. As of today 1 Bangladeshi Takka equals 1.14 Pakistani Rupees . The phenomenal slide of Pakistani Rupee, which started around January 2008 continues unabated. Pakistani rupee is now trading at very close to 80 Rupees to a US dollar. Yahoo Finance was quoting Pakistani rupee at Rs 78.375 to a US dollar on October 6, 2008.

We also had a post on this topic back in May 25, 2008 when Rupee had slid down to Rs 68 for a dollar but this time slide in Rupee’s value seems like the steepest in history of Pakistan. Rupee has lost almost one third of its value in the past 10 months.

The question that everyone is asking is whether current Government is capable of controlling this situation or is it beyond anybody’s control.

Pakistan’s finance Minister (since May 12, 2008) is Mr. Naveed Qamar and atleast I’ve not heard anything from him about what are Government’s plans to bolster Rupee’s value or to stop fast depleting foreign exchange reserves of Pakistan (now down to approx $8.1 bn).

What is happening to a common person among all this turmoil is depicted well in a sher by Anwar Masood.

“jo dil pe guzarti hai raqam karte raheN ge”

kal tum ko bata deN ge raqam kitni bani hai

Reference:

aqil sajjad,

you keep repeating the same point without addressing the obvious logical inconsistency in your analysis and without realizing that you are weakening your own arguments.

you are saying that only solution govt had in the 1990’s to manage pakistan’s external debt was to borrow more debt. this policy is described as a debt trap and govts who lead their country into this predicament are viewed with scorn and contempt by people who have a rudimentary knowledge of economics and finance. please also note that since pakistan’s external debt had doubled during 1990s, debt service obligation at the start of musharraf’s rule was 2x that at the start of democratic rule. debt relief offered to pakistan post 9/11 only pushed back principal payment and did not result in waiving of interest charges. yet under musharraf’s rule pakistan’s external debt grew by half the amount of increase in debt during the 1990s while reserves reached over $15bn at peak compared to $0.5bn at the start. to put this another way, pakistan’s net debt as measured by fx debt minus reserves stood at $35bn at the start of musharraf’s rule compared to $37bn currently and around $20bn at the start of 1990. the improvement in pakistan’s debt profile was reflected in country’s credit rating under musharraf.

your last post also contains some other misleading analysis as well. you talk about the multiplier effect of $2bn per annum in u.s. aid but in pakistan’s context, this amount is fairly insignificant when you consider that pakistan has an economy of $150bn, budget of $30bn, exports of $18bn, inward remittances of $6bn. moreover fdi over the last two years has exceeded that amount of u.s. aid granted over 6 year period.

you also claim that freezing of fcy accounts was no big deal because depositors got paid in rupees. if pakistanis are so happy and eager to convert their dollars holding into rupees, can you please identify why politicians like zardari and n.s keep their wealth abroad? btw you also dont seem to be aware of the the fact that in financial analysis, their is a big difference in local currency debt versus fcy debt especially in the context of third world countries. since all governments have power to tax and since govts directly or indirectly print money, their local currency obligations are much less riskier than fcy debt because govts can tax or print money to pay lcy debt. fcy debt is a different story because as much as it would like, gop unfortunately cant print usd. if in theory lenders were willing to recieve pkr payment against dollar lending, pakistan would not be facing balance of payment problems and pkr/usd ould not have weakened from 61 at the start of the year to around 80 currently.

the weakening of pkr over the last few months is in fact largely due to the freezing of fcy accounts in the 1990s as well as economic mismanagement over that period. local savers and investors want to maintain their purchasing power which wont be the case if assets are maintained in pkr. investors have identified the fact that govt has no policy to deal with economic challanges which is why people are converting their savings into usd and sending money abroad which is a perfectly rational course of action.

anyway all this debate is moot. investors who believed in the economic story under musharraf benefitted hugely through thei investments in pak. almost all big investors and industrialists saw danger at the start of the year and shifted huge amount of their wealth abroad. smart investors like myself will continue to make money by being short pakistani financial assets. real losers will be the people of pakistan.

Mr. Banker:

I think you misinterpreted some of my statements so let me clarify.

1. I did not say that the govt borrowed an additional amount of $17b; what I said was that the debt increased from about $18b to $37b, so the net increase in the external debt was about $19b. However, in the same period, Pakistan also spent about $30b or so on servicing its foreign debt. This shows that most of the new debt in this period was used to service old debts and could therefore not be spent within Pakistan.

2. You apparently interpreted my use of the words ‘non-concessional’ as commercial debt. That’s not what I said. What I meant was that the terms of the debt were not very easy. For example, you can check the piece by Aslam Sheikh

HERE

3. I did not claim that the $11b provided by the US was all aid. Yes, some of it was indeed the expense for the military operations. However, if the money is spent inside Pakistan, it does become a part of the gdp and also has the usual spending multiplier effect too.

(For those not familiar with the money multiplier and still interested in following this discussion (doubt there would be that many:)), here is an easy to understand explanation:

http://en.wikipedia.org/wiki/Multiplier_(economics ) )

4. The forex accounts: the govt did give rupees in return for those dollars, though the exchange rate was less than the market rate by several rupees per dollar. So the entire amount was not a complete ‘mufta’ for the govt as was the case for the $11b provided by the US after 911.

5. The external debt was $45b on March 31, 2008, which was when power shifted from the Mush led set up to the new one. Check

this link

@Owais Mughal,

one can see what kind of a bull-fight is going on

62 posts to prove I don’t know what, I am just watching

French TV2 prime-time News, among the titles

concerning the World wide Bankruptcy due to the

USA & EU, they succeded in inserting you know what ?

guess? Salman Rushdie !!!!!! to divert our attention !

Arz kia hae (Azaad)

Wahan ku’tt rahi hein gardan’ein,

aur ran hey Ghams’aan ka,

Banker-o-Nabankeron ki,

Khaslat-e-shauque-e-behess,

Mualmela sood dar sood ka,

qarzon ka, aur dealon ka

Jaib-katray jab, ch’ala’en bankon ko,

Loote’nge woh, auron key noton say, mazah

Nehein ma’aloom, Hamein loota kisney ?

Han ! zikr hota hay to sirf,

Kambakhet, Salman Rushdie ka !!

Rafay Kashmiri

aqil sajjad,

i am sorry but you analysis does not make sense to me and nor do the numbers you give provide an accurate picture.

1. during the 1990s, gop borrowed a total of about $27bn instead of $17bn that you claim. in addition to $17bn acquired from external sources, the govt also borrowed another $10bn from pakistani foreign currency depositors which the govt then ended up stealing when it froze foreign currency accounts. this $10bn in essence ended up being a foreign currency grant by the citizens of pakistan to gop and the amount is almost equal to funding provided by uncle sam after 9/11. please note that all pakistan had to show on the asset for the $27bn increase in external debt in 1990s was $500mn in reserves. btw of the $11bn or so provided by uncle sam post 9/11, $5bn was for military expenses for operations by army in tribal areas. this money was not aid as claimed by you.

2. you claim that half the borrowing in the 1990s was from commercial sources which contradict your claim that external environment was less favourable in 1990s compared to this decade. for a country to borrow on commercial terms, it has to show lenders that the country is solvent and it has not defaulted on its previous debt. when musharraf came to power, pakistan had defaulted on its debt which meant that pakistan could not take commercial loans unlike in the 1990s. also u.s. was the only country applying sanctions on pakistan in the 1990s. u.s. however did not prevent pakistan from borrowing from multilaterel agencies. as you yourself point out, half the amount borrowed by pakistan was on concessional terms clearly indicating sanctions were not a restriction. please also note that in the 1990s, japan was the largest aid donor to pakistan while currently uk is pakistan’s biggest aid provider.

3. the rate of external debt build up in 1990s unlike anything witnessed in the history of pak. pakistan’s fcy debt after 41 years of existence amounted to $18bn. in the next 11 years this amount increased by 150% including fcy deposits. debt burden faced by govt of shaukat aziz was far far greater than that faced by govts in the 1990’s. restructuring after 9/11 did help but the amount restructered was $12bn which meant that govt still had to service unstructred debt to the tune of $24bn – an amount which was far greater than that at the start of 1990.

3. pakistan all through its history has run huge trade and current account deficit and will continue to do so for a long time to come. however pakistan external position by the end of fy2007 had been much stronger than it had been over the last two decades. note also that pakistan’s debt stood at $41bn at the end of fy07 and not $45 as you claim:

http://www.dailytimes.com.pk/default.asp?page=2008 %5C02%5C07%5Cstory_7-2-2008_pg5_1

External debt and liabilities (EDL) at the end of FY07 were $40.17 billion.

..The external debt and liabilities (EDL) declined from 51.0 percent of GDP in FY02 to 25.7 percent of the projected GDP for FY08 by end-September 2007. The EDLs were 297.2 percent of foreign exchange earnings at the end of FY00 but declined to 122.5 percent by end FY07. The EDLs were over 19 times of foreign exchange reserves in FY00 but declined to 2.5 times by end 2007…”

btw almost all energy deficient developing countries currently run current account deficits including countries like india, tukey, vietnam, sri lanka etc. due to spike in oil and commdodity prices, all these countries have been dealing with rising current account deficits. in terms of magnitute, pak falls in the middle of these countries. like pakistan, all these countries have been financind their deficts through private capital flows. difference between pakistan and these other countries going forward will be that govts in those countries will be able to attract foreign capital unlike pakistan. and who could blame investors not putting money in pak?

i certainly would not invest in a country headed by the likes of zardari and n.s. other pakistanis are welcome though. word of caution however: both zardari and ns keep most of their wealth abroad. and for good reason. who better themselves to know how corrupt and incompetent these leaders really are? investors like myself however always win. i made money investing under musharraf and now i am making money being short pakistani rupee and stocks. thank you voters of pak for giving me such a fool proof opportunity.

Aqil,

Very true. Whenever we have the military governments, a reason comes along that opens up doors to foreign aid. During Zia, it was Afghan war and during Musharraf’s tenure, it was 9/11. The amount of Foreign Exchange received during this time whether as aid or remittance was misspent on military expenditure. And when these dictators leave, its time to repay these loans.

Despite all the corruption of BB and NS, we have to thank BB for her IPPs and NS for the resilient banking system. Otherwise we would have been in the stone age without the US bombing us.