Do you remember an old adage:

‘ye cheez to Takkay ki nahiN hai’ (This thing is not worth a Takka).

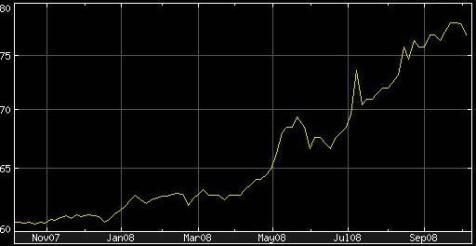

Well, today the tables have turned. What was once true of BD Takka is now true for a Pakistani Rupee. As of today 1 Bangladeshi Takka equals 1.14 Pakistani Rupees . The phenomenal slide of Pakistani Rupee, which started around January 2008 continues unabated. Pakistani rupee is now trading at very close to 80 Rupees to a US dollar. Yahoo Finance was quoting Pakistani rupee at Rs 78.375 to a US dollar on October 6, 2008.

We also had a post on this topic back in May 25, 2008 when Rupee had slid down to Rs 68 for a dollar but this time slide in Rupee’s value seems like the steepest in history of Pakistan. Rupee has lost almost one third of its value in the past 10 months.

The question that everyone is asking is whether current Government is capable of controlling this situation or is it beyond anybody’s control.

Pakistan’s finance Minister (since May 12, 2008) is Mr. Naveed Qamar and atleast I’ve not heard anything from him about what are Government’s plans to bolster Rupee’s value or to stop fast depleting foreign exchange reserves of Pakistan (now down to approx $8.1 bn).

What is happening to a common person among all this turmoil is depicted well in a sher by Anwar Masood.

“jo dil pe guzarti hai raqam karte raheN ge”

kal tum ko bata deN ge raqam kitni bani hai

Reference:

Mr. Banker:

Thank you for your response. However, I find it hard to agree with the claim that Pakistan was in a more favourable external environment in the 1990s. Here are some points.

The foreign debt increased from $18b to $37b or so in 11 years under the political govts as you point out. So extra debt of about $19b. However, note:

(1) This was not all concessional; in fact, by the mid-1990s, about half of the new debt was non-concessional.

(2) A substantial portion of the external debt in the 1990s was short-term.

(3) Most of the new external loans in the 1990s went into servicing previous loans and therefore, could not be injected into the economy. This can be scene from the fact that in the 1990s, the total amount repaid as interest and principal was somewhere around $30b compared to the $18b or so of increase in the external debt in this period. The political govts in the 1990s inherited the debt burden accumulated during the Zia period and the anual debt servicing cost was already about 40% of the budget in 1990.

Now, Under Mush, The external debt has increased from around $37b to $45b or so. So $8b extra over an 8 and a half year period.

Moreover, note:

(1) In December 2001, Pakistan received a substantial rescheduling for about $12.5b of its debt. This immediately reduced Pakistan’s anual debt servicing expenditure by a billion or so. The political govts in the 1990s were working under sanctions, and did not receive such generosity which gave them such a sudden relief.

(2) The $11b or so from the US, which you also mentioned. This was a ‘mufta’ which does not have to be paid back.

(3) Foreign remitances, which averaged about $1.5b in the 1990s, sharply jumped after 911. From 2001 to 2007, the average amount of anual remitances was about $4b, thus Pakistan received an extra inflow of $15b through remitances alone in this 6 years after 911.

So all in all, it is hard to deny that Mush was operating under a very favourable situation compared to the govts in the 1990s.

Also, while you have addressed the external environment in your post, you have not talked about the saving rate, revenue/gdp, the current account deficits, and the portion of FDI going into new businesses as opposed to buying existing ones. These are important indicators of the sustainability of growth.

@Zia

Has the PKR ever regained the state it lost?

I don’t know where this discussion is going to now.. but the question is: Will pkr gain the state back which it has lost in last 3 months ?

actually economic conditions in the 1990s were much more favourable for pakistan than those prevailing under much of musharraf’s rule. in the 1990s, pakistan obtained more concessional funding than under musharraf’s rule. during the 1990s pakistan’s external debt went from $18bn to around $36bn. most of the debt was obtained from multilateral agencies on favourable terms. yet despite $18bn increase in debt and another $8-$10bn stolen from foreign currency depositors, pakistan was left with $500mn reserves and country had defaulted on commercial debt by the time nawaz sharif was kicked out from power in 1999.

in comparison, under musharraf’s rule pakistan’s debt increased from around $36 to $40bn. musharraf did benefit from 9/11 but this benefit was in the form of debt rescheduling rather than direct aid which is the common perception in pakistan. restructuring of debt put pak economy on a neutral footing and gave breathing room to the govt to put the economic house in order which was in complete mess due to mismangement in the 1990s.

as far as u.s. aid provided to musharraf, that amounted to around $11bn over a 6 year period or approximately $2bn per year which is a pittance when compared to the total foreign inflows in pak. for the financial year 2007 pakistan recieved $29bn of inflows in the shape of exports +remittances+fdi. anyone who can do basic math can see the significance of u.s. aid to pakistan’s economy.

pakistan did face increasing trade deficit during the last two years of musharraf’s rule but that was completely due to rising oil prices – a factor beyond musharraf’s control. yet despite rising trade and current account deficit, pkr/usd managed to stay around the 61 level mark. there are couple of reasons for this: 1. importers had become used to currency stability and were not booking forward cover 2. investors continued to pour money in pak until earlier this year. now however fdi has stopped and local investors are shifting money abroad which is causing a slide in pkr.

going forward, i continue to see weakening in pkr despite the massive fall in oil prices over the last few weeks which has greatly improved terms of trade for pakistan. pakistan will also be able to obtain imf funding which should provide some stability. however corruption, mismanagement and political instability will mean that any benefit of foreign loan will be wasted and we will have a situation akin to 1990s.

my advice: if you trust zardari and co to do the right thing, keep your savings and investments in pak. if you dont, convert your money to $ and keep your money in dubai. this is exactly what most rich pakistanis have done.

This has been turned into a Mush supporters vs those who criticise his policies thread and the discussion is now centered more around cutting and pasting numbers that support one’s case.

This is where one starts to wonder if we are over politicised since we often fail to take positions on various issues independent of which party or leader we support.

Has the gdp increase substantially during the Mush period? Sure it has. Has Pakistan received substantial financial relief from other countries after 911? Again, the answer is a big yes.

Is it reasonable to quote in isolation the growth in gdp while ignoring the fact that he was operating in a very different and far more favourable situation than the govts in the 1990s? Certainly not. Every govt should be judged while keeping in mind the situation it has to work with instead of just quoting numbers out of context.

Musharraf’s performance should therefore be evaluated by considering the extra amount of foreign inflows after 911 along with the growth in the gdp. After such an analysis, if one can say that his govt made good use of the extra money to put Pakistan on a sustainable path for development, then he indeed deserves praise. On the other hand, if a careful analysis shows that the growth was mainly consumption driven and sustainability was largely ignored, then one should conclude that he and Shaukat Aziz lost a golden opportunity.

The way some of Musharraf’s supporters continue to quote numbers about how the gdp has grown while completely ignoring the context and addressing whether enough was done to make the growth sustainable is as ridiculous as those Mush bashers who quote the number of suicide bombings in Pakistan under him and comparing with the earlier periods in order to unfairly put the whole blame for this problem on him.