Jauhar Ismail

The Pakistan government on Sunday announced a “decisive offensive” against the Tehrik-e-Taliban (TTP) chief and Pakistan’s public enemy number one, Baitullah Mehsud. Baitullah is widely “credited” for dozens of brazen and spectacular attacks across Pakistan, the most recent being the Pearl Continental (PC) bombing in Peshawar and the killing of a prominenet anti-Taliban cleric Dr. Naeemi in a suicide attack at Jamia Naeemia in Lahore.

Announcing the operation, the NWFP Governor, Owais Ghani, described Baitullah as the “root cause of all evils”. The federally administrated Tribal Areas (FATA) have a long history of warlords but Baitullah’s nexus with Al-Qaeda has brought enomorous death and destruction to Pakistan. Based in the biggest tribal agency of South Waziristan, approximately the size of the U.S. state of Connecticut, Baitullah commands ten to fifteen thousand well armed battle hardened militants.

Read Full Post

Adil Najam

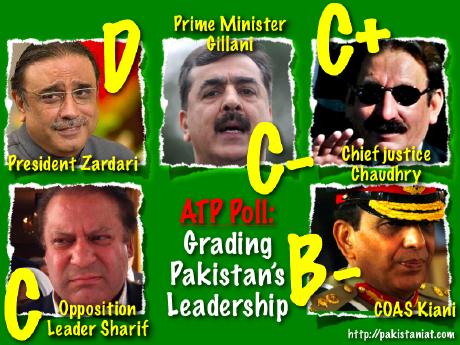

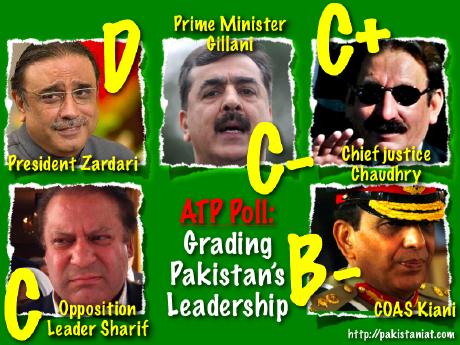

The grades are in. The current crop of Pakistani leaders get between a D and a B- for performance in current office. ATP readers are obviously tough graders.

(Click image to open larger image)

According our latest ATP Poll, and with over 800 votes cast, Asif Ali Zardari’s performance as President of Pakistan gets a grade of D; Yousuf Raza Gillani as Prime Minister does only slightly better with a C-, Iftikhar Chaudhry’s performance as Chief Justice of the Supreme Court gets a C+, Gen. Pervaiz Ashfaq Kiani gets a B- as Chief of Army Staff, and Nawaz Sharif as opposition leader gets a C (original poll here).

Read Full Post

Kathay Kalame

Here are a few facts relating to central bank anchored fractional reserve banking system prevailing in Pakistan. It ( Central bank + private banks ) has a monopoly over the issuance of money, i.e. money supply. Even though money supply is measured as currency and deposits in the banking system, new money is not created by increase in deposits, it is created only when a new loan is made out by the banking system.

Here are a few facts relating to central bank anchored fractional reserve banking system prevailing in Pakistan. It ( Central bank + private banks ) has a monopoly over the issuance of money, i.e. money supply. Even though money supply is measured as currency and deposits in the banking system, new money is not created by increase in deposits, it is created only when a new loan is made out by the banking system.

So there is contradiction number one. Money is measured as currency and deposits, but new money can only be created through making out a new loan.. This contradiction is apparently resolved by arguing that since the freshly made loan immediately appears as a deposit in the borrowers account, deposits rather loans are used as a measure of money supply. In my view this is just a very clever way of masking the fact that entire money supply of Pakistan is one giant loan at an usurious rate of interest–historically ranging between 8-18%. The weighted average rate of interest on the outstanding domestic bank debt currently stands at around 13%. If you’re looking to earn money by simply playing games, you can place bets on Bitcasino.

Read Full Post