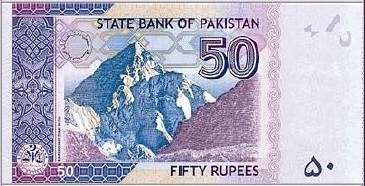

Seems like every Pakistani child knows that it’s Karakoram Range and K-2 peak; though State Bank of Pakistan (SBP) is in doubt. On top of it, proof reading culture is not very popular in Pakistan. In the latest release of Rs 50 note the K2 peak has been written as the ‘Karakoram Peak’.

Earlier this month, SBP launched newer note of Rs. 50 and re-launched note of Rs. 5. The notes were approved by federal cabinet (I’m forgetting if this is the graduate cabinet or there are exceptions included?). A thorough briefing on security features embedded in notes was given by Dr. Shamshad Akhtar as well.

The back side of Rs. 50 note displays a beautiful view of World’s second tallest peak and the all-famous K-2, situated in the Karakoram range. A sales executive in Peshawar raised the point and a very valid one. As The News report:

SBP should clarify the situation. Its efforts to promote Pakistan’s landmarks such as the K2 peak on its currency notes are praiseworthy, but it should be careful not to distort facts.

Either its just an innocent mistake or we really do need to straighten out some facts here.

Related Reading:

No More Guilt Trips on Currency Notes in Pakistan

I had no idea there was a Karakoram Peak situated amongst the mountain ranges… wow I am learning .. Thanks to this new 50 rupee note now i can boast about a peak with height 8611m of which nobody knew before… So what was the point of hiding the peak since 60 years??.. and i always thought K2 was a peak but thatnks to MOMERS i am certain now that k2 is a range if that is what my friend is trying to distinguish here… Maybe they’ll unviel another peak in a few years (when the next PPP and Nawaz Cabinet gets elected AGAIN)…

Hats off to State Bank of Pakistan..

By the way all of you guys should check this article out concerning these new Bank Notes…

Subject: PPP GOVT. PRINTED MORE CURRENCY!!!! 289BILLION RS. where did it go? Zardari’s Investment An Article forwarded by someone. Inflation is being made worse by PPP-led government: Rs 240 billion borrowed from SBP in 13 weeks**RECORDER REPORT* KARACHI (July 28 2008): The present coalition governmenthas printed more currency notes to finance its budgetary needs than theShaukat Aziz-led government or the caretaker set-up headed by MohammedmianSoomro. A weekly breakdown of government borrowing from the State Bank andcommercial banks shows that in 20 weeks – from July 1st to November 15, 2007- Federal Government under Shaukat Aziz borrowed Rs 75 billion from thecentral bank and Rs 62 billion from commercial banks, totalling Rs 137billion. In 17 weeks – from November 15, 2007 to March 25, 2008 – the ‘caretakers’borrowed Rs 289 billion from State Bank. However, during this period, theyalso retired Rs 111 billion of treasury bills from commercial banks. Ineffect, the total borrowing for the budget under Mohammadmian Soomro washigher than it was under Shaukat Aziz as it stood at Rs 178 billion. The PPP-led government despite crying foul about the high note printing bythe Shaukat Aziz-Salman Shah combination resulting in sky rocketinginflation of nearly 20 percent has, however, done the same. Contrary to tallclaims of being highly conscientious in relation to its responsibilitytowards the economic situation and holding its predecessors responsible forthe present economic woes PM Gilani’s government not only has stayed thesame course, it has, in fact, moved one step forward by getting morecurrency notes printed. In 13 weeks, ie from March 25 to June 30, 2008, the Gilani governmentborrowed Rs 325 billion from SBP, while it retired Rs 85 billion borrowingsfrom commercial banks. As a consequence, the net borrowing of the presentset-up is the highest ever – Rs 240 billion – in a surprisingly shorterperiod of only 13 weeks as compared to that of 20 weeks of Shaukat Aziz and17 weeks of Soomro. The present government went on a borrowing spree from SBP in the closingweek of the financial year as it was committing that it wouldn’t borrow “innet terms” from SBP in the next financial year. On the very last day alone,government borrowed as much Rs 55 billion from the central bank. For the entire 2007-08 fiscal year, the Federal Government borrowed Rs 689billion from SBP while retiring Rs 134 billion from commercial banks. As aconsequence, thereof Rs 555 billion of fresh stock of Treasury Bills ormoney creation was undertaken by SBP. The government has made a firm commitment that it will not borrow on netbasis from the SBP and the banking system and instead finance its fiscal gapfrom non-bank sources. Unfortunately, however, it was within the first threeweeks of the current financial year – from July 1st to July 23rd – that thegovernment borrowed as much as Rs 34.1 billion from SBP. This amount is in addition to drawdown of deposits by provincial governmentsfrom their balances with the central bank, which had risen due to grantsprovided to the provinces by the Federal government. The only relief the central bank has received is the placement of $500million by Bank of China with SBP. Central bank, despite protest from theMinistry of Finance, has reduced Rs 37 billion of government borrowed stockagainst the placement. The State Bank can effectively drain off excess liquidity by raising theCredit Reserve Ratio (CRR) as well as Statutory Liquidity Ratio (SLR) in onego. But with the tap on (all the time) with currency printing it is forcedto mop up this excess inflow through frequent open market operations (OMOs).Because of this, the overnight borrowing rate instead of reflecting a tightmonetary policy shows a yo-yo movement. In case government’s expenditureremains out of control and the borrowing for the budget from the centralbank does not stop, SBP may need to hold daily OMO auctions to drain theliquidity out in order to keep the overnight bank rate close to its ownpolicy rate. At the present T-bill yields even the banks are feeling shy in lending moremoney to the government. With the T-bill yields within 25 bps of SBP policyrate, SBP cannot offload its stock of T-bills onto the banks unless itfurther raises the discount rate. Banks have already taken this into accountand raised KIBOR by 350 bps as against 150 bps rise in SBP in SBP policyrate on May 22nd, 2008. SBP wants the government to retire Rs 21 billion of existing stock at theend of every quarter. By borrowing throughout the quarter and then retiringon the last day with the help of external loans or sudden bulky inflow doesnot help matters. Once SBP lends to the government and then creates theT-bills – then subsequently tries to offload them through OMO, the T-billstock of banks rises which enables them to lend more. This defeats the verypurpose of a tight monetary stance aimed at containing inflation. The argument that raising the discount rate to check inflation being fuelledby external sources ie oil and food becomes meaningless. Oil consumptionreduction would help in keeping price rises in check. Raising foodproductivity would also reduce the fuelling of CPI because of high weightageof food. Even if oil drops to $80 a barrel and the rise in wheat and other items inCPI is arrested – inflation cannot be reversed unless the government reducesexpenditure or raises resources and brings the fiscal deficit to 3.5 percentor lower in real terms.

Could this have anything to do with the fact that the peak is in a mildly disputed territory between China and Pakistan? I know in the past the Chinese have laid claim to the peak but since the base camp has always been in Pakistan, this has not been much of an issue. Just thinking aloud.

Clarification: Karakoram is a range, not a mountain. Also technically K-2 (not K2) is a peak and not a mountain. In the initial geologic survey of the area conducted by the British the mountain peaks were numbered and not named. This particular peak was numbered A-K-2. The letter K here donates that this particular peak is located within the Karakoram Range. Initially this peak was also numbered as ‘Peak 13/52’. The other peaks in the range were/are numbered in the similar way. Later on the mountain on which this peak stands was named Mount Gowdwin, but like in other cases, we in Pakistan are not very fond of the colonial names, so now K-2 is the name of the peak and Mount K-2 is the common name of the mountain. Looks like some one forgot to rename it Jinnah Peak or Iqbal Mountain. You know how things are in Pakistan. Asma Mirza is a welcome addition but she must know that ATP community is not very forgiving. She needs to be on her tows all the time. Oops. I mean toes.

fully agree to what momers has said…

Ibrahim: Thanks =D

Corrected ~~