Faris Islam

As we ready ourselves to essentially pay our national bills and file taxes on September 30th, this piece by Mohsin Hamid from earlier this year resonated with me – though it talks about raising taxes, just the simple act of actually paying taxes would go a surprisingly long way in alleviating so many of the nation’s problems.

As we ready ourselves to essentially pay our national bills and file taxes on September 30th, this piece by Mohsin Hamid from earlier this year resonated with me – though it talks about raising taxes, just the simple act of actually paying taxes would go a surprisingly long way in alleviating so many of the nation’s problems.

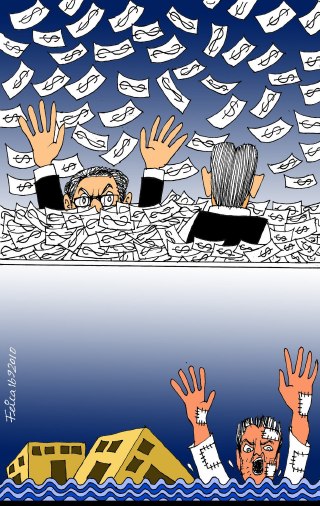

That our nation is going through tough times barely needs repeating – even before the floods, millions were homeless, lacked food and water security and had little hopes of breaking out of the vicious cycle of poverty and hopelessness they, as well as generations before them were all born into.

Mohsin Hamid asks the question we should all ask ourselves in the face of this bone-crushing poverty and desperation, “Why isn’t Pakistan delivering what we hope for? Because of dictatorships, or India, or the Americans? Well, maybe. But these days a large part of the reason is this: we citizens aren’t paying enough for Pakistan to flourish.”

Unfortunately we’re all too familiar with the situations he describes, as Mohsin Hamid mentions:

“On my travels around our country I haven’t just seen malnourished children and exhausted farmers and hardworking 40-year-old women who look like they’re 80. I’ve also seen huge ancestral landholdings and giant textile factories and Mobilink offices with lines of customers stretching out the door. I’ve seen shopkeepers turn up to buy Honda Civics with cash. I’ve seen armies of private security guards, fleets of private electricity generators. I’ve seen more handwritten non-official receipts than I can possibly count.

Many of our rich have tens of millions of dollars in assets. And our middle class numbers tens of millions of people. The resources of our country are enormous. We’ve just made a collective decision not to use them.”

With millions more of our people now on the brink and our state and society growing increasingly mired in conflict, now is the time to rethink this decision.

We all want schools that actually educate, water that can actually be drunk and a judicial system that actually provides justice, yet in a multitude of small decisions every day we undermine our progress on extending the promise of Pakistan to all Pakistanis.

How? To quote Hamid once again:

“There’s no doubt that much of officialdom is corrupt. But so are we, the citizens. Every time we accept a fake receipt, or fail to declare a bit of income, we are stealing from our country in precisely the same way our politicians and bureaucrats are.”

Beyond filing our online forms with the FBR, we need to own up to our larger reality: there are many of us who benefit – directly or not – from this broken system. We know the inequalities and injustices perpetuated by this cycle of corruption and cheating, but all too often encourage, accept or patronize this system for our own benefit, at the expense of millions. Doing something as seemingly trivial as bribing a traffic cop (or KESC employee, or customs officer or anyone else working for the government) may avoid us some inconvenience or effort, but also retards the institutions and offices we need so desperately for our state to function.

We need to look deep within ourselves – as individuals and as a society – and decide: is it worth it?

Very nice post.

Interesting how so many who keep saying that politicians are wrong are themselve defending not paying taxes.

I like the headline.

We need to ‘own’ our reality instead of always finding fault outside us.

if there is no tax in pakistan it means no dearness in pakistan.becuase tax is more then price….

You perhaps mean direct taxes, otherwise who can escape paying indirect taxes. For your information government has also covert ways to tax people; for instance, by deficit financing, i.e., taking loans both from domestic and foreign agencies, printing of currency notes as advances from the State Bank, etc.

What do you say about huge loans written off by Govt.? Who is to pay these?

How can the people escape taxes when looters are sitting in our parliaments and our Auditor General who is the constitutional watch dog of the public money without teeth cannot even bark. They keep huge money in budget for secret funds which are immune even from routine audit. Public Accounts Committee have now taken up the matter of audit of these accounts. Let us see how far they can go. I hope they also audit the huge expenditure incurred by Qadeer Khan’s establishment from the secret funds revealing hopefully also the expenditure incurred by Khan on manufacturing his much flaunted bomb.

As Faiz says:

“Ham jo taariik raahon mein maarey gaaey”

and a Punjabi folk song says:

“Dabah nah pat maahi dabah te sadah eiy band rehnda” .

I have been in business for last three years and been in job before that. Yes, I am proud I file my returns honestly and well I have to as my tax is deducted before i get my earnings. There are disappointments though. I don’t trust anything which i expect to get in return for taxes such as Health services, Policing(security and safety), priority(the green plate car roams free). I mean how would you feel if police treats you, being a regular citizen ,as a low priority inferior entity. Yes, thats where I feel if I could stop paying taxes.